NEW YORK (CNNfn) - Psst! Want to work from home? Earn big bucks?

Then delete all those "make-your-millions-stuffing-envelopes" ads from your e-mail in-box, and try an accounting degree instead.

Insiders say such a profession provides college grads with dozens of interesting career choices, and more importantly, the kind of flexibility most of us only dream of. From home-based consulting to new fields in forensic accounting and high-tech auditing, they say, opportunities abound.

"When I began my major I had this stereotypical view of what the accountant did; the bean counter image," said Katherine Rozier, 22, a 2000 accounting graduate of the University of Texas at Austin. "But I found out there are so many different opportunities out there. If you understand accounting, then you understand the language of business and that's definitely going to benefit me whether I stay at my current job forever or change careers every four years."

Rozier, who completed a 5-year combined bachelor's and master's degree program, now works for the international tax planning division of Deloitte and Touche in Washington. She hopes to pursue a law degree someday, but before that, a little adventure may be in order.

"I hope to go overseas and I'm looking at France, Ireland and England," Rozier said. "With any of the Big Five accounting firms, they'll train you for that. You just have to take the initiative and they'll help you make it happen. There are so many different opportunities"

Life of the "bean counter"

Accountants and auditors, which generally are lumped together, perform jobs that help companies and organizations run more efficiently. More specifically, the Bureau of Labor Statistics notes, they work to ensure the accuracy of  public records for investors, regulators and taxpayers by preparing, analyzing and verifying financial documents. public records for investors, regulators and taxpayers by preparing, analyzing and verifying financial documents.

Time was, as Rozier points out, accountants whiled away their days in tiny cubicles balancing the books for corporations, individuals, nonprofits and government agencies. Not anymore.

Nowadays, all that information is stored in complex computer databases, which means accountants must be highly trained to interpret and, in some cases, even develop financial software and information systems.

"A lot of accountants are being hired by Internet and technology companies to design their traditional information systems," said Joe Bittner, manager of career services for the American Institute of Certified Public Accountants (AICPA). "Companies may be great at making computers that can wash the clothes and do the dishes, but the computer programmer is unlikely to know enough about accounting to design a complex computing system [that enables companies to maximize efficiency]."

Visit CNNfn's Career page regularly to read "Working your Degree," a new column that highlights job opportunities for a different college major each week. Click here for a list of previous profiles of the biology, political science, engineering, economics, and computer science, physical therapy, history and teaching professions.

Finding employment

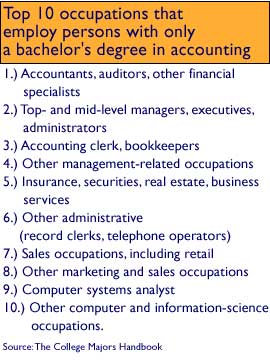

Career options for accounting grads abound. The list of jobs outlined by the BLS includes appraisers, auditors, budget officers, loan officers, financial analysts and managers, bank officers, actuaries, underwriters, tax collectors and revenue agents.

Not enough? Accountants also have the educational background to become a special agent for the Federal Bureau of Investigation (FBI), securities sales representatives or purchasing agents. There are some, too, who specialize in areas such as employee health care benefits and compensation or even forensic accounting, where the benefits of mergers and other complex financial transactions are evaluated, and white-collar crimes like money laundering are investigated.

Auditing is among the fastest growing - and highest paying - fields for accounting majors. Companies, government agencies and nonprofit groups hire them to guard against fraud, reconcile records and ensure that profits, budgets and expenses are stated correctly.

Professional auditors, the BLS reports, also review company operations to evaluate their efficiency and compliance with corporate policies, laws, and government regulations. As such, a variety of auditing specialty fields have evolved, including electronic data processing, environmental, engineering, legal, insurance premium, bank, and health care auditors.

Bear in mind that many of the job opportunities available to accounting grads are so closely related that it's easy to shift gears throughout your career.

"In general, there is a large degree of mobility among public accountants, management accountants, and internal auditors," the BLS writes in its latest Occupational Outlook survey. "Practitioners often shift into management accounting or internal auditing from public accounting, or between internal auditing and management accounting."

Going it alone

There's a fair amount of entrepreneurialism in the field as well.

The College Majors Handbook, published by JIST Works, Inc., finds that the vast majority of accountants - some 65 percent - work for private corporations, accounting, auditing and bookkeeping firms, with roughly 12 percent working in government or military jobs, and 8 percent in the nonprofit or education arena.

The remaining 15 percent work for themselves, either as a small business owner or a consultant.

"Many [public accountants] not only work from home, but they can work from remote islands if they want," Bittner said. "A lot of what we do is to go out and meet our clients, but once you've sat down and discussed with them their business plan you can do the actual work from any location."

The job

Accountants and auditors held roughly 1.1 million jobs in 1998, according to Labor Department data.

Overall, job opportunities for accountants and auditors are projected to grow between 10 percent and 20 percent through 2008, about as fast as the average for all occupations.

Many are unlicensed management accountants, internal auditors or government accountants and auditors. But a large number, too, the Bureau reports, are licensed Certified Public Accountants (CPAs), Public Accountants (PAs), Registered Public Accountants (RPAs), Certified Management Accountants (CMAs) and Accounting Practitioners (APs).

Bittner stressed the advantages of becoming a Certified Public Accountant, or  CPA. Earning such a credential requires bachelor's degree grads to pass a rigorous four-part exam, in addition to a slew of prerequisite. CPA. Earning such a credential requires bachelor's degree grads to pass a rigorous four-part exam, in addition to a slew of prerequisite.

Why do it? Bittner said CPAs go on to earn substantially more - 10 percent more on average - than those who do not pass the exam. Many, too, he said, are able to climb the corporate ladder more quickly to claim top posts including Chief Financial Officer and controllers of large companies.

Remember, too, that most managerial positions at large accounting firms are open only to those who have obtained a CPA.

"I think the best analogy is the pair of law school students where one sits for the Bar exam and the other doesn't," Bittner said. "Who are you going to choose for your lawyer?"

Lastly, passing the coveted CPA exam can add a great deal to the flexibility accounting majors already have.

"Accountants with CPA licensure, certifications and educational specialization, including international business and current legislation, will have the most number of career options," the BLS writes in its Occupational Outlook report.

If you're interested in becoming a CPA, keep in mind that 17 states currently require CPA candidates to complete 150 semester hours of college coursework. That works out to 30 extra hours beyond the standard 4-year degree. Most other states have already adopted similar legislation, the BLS notes, that will take effect in the near future.

A few years work experience may also be required before you can even sit for the exam and the BLS points out that only 25 percent of those who take the exam each year pass every part they attempt.

If you've already earned a degree in accounting and are looking for a job, there are lots of Web sites focused on career opportunities for your niche including accounting.com, Tax-jobs.com and accountingjobs.com.

Paycheck Check-Up

Salaries in the field can be substantial. Data from the National Association of Colleges and Employers reveal bachelor's degree candidates in accounting this year saw starting offers climb 6 percent to $36,710.

And for those well established in the profession, The College Majors Handbook notes salaries reach nearly $57,000 a year - that's more than 17 percent above the average annual pay for all persons with a bachelor's degree. Those who are self employed earn more still, averaging $72,000 per year, which is more than 40 percent higher than the average for all accounting grads.

(Click here for CNNfn's Salary Sample, showing average annual earnings of accountants and auditors in 10 major U.S. markets.)

Top- and mid-level managers, executives and administrators with an accounting degree earn the most at $74,000 a year, followed by their colleagues in the insurance, securities, real estate and business services arena who earn closer to $62,000, the Handbook reveals. Accountants, auditors, and other financial specialists earn in the mid-$50,000 range on average, along with those classified as "other management-related occupations."

Finally, those in the sales and marketing fields earn roughly $45,000, while accounting grads who become clerks or bookkeepers earn roughly $30,000 a year.

Who's best suited

If you're good with numbers and you value career flexibility, accounting may just be the field for you.

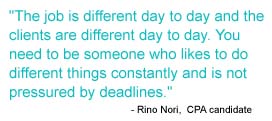

"The job is different day to day and the clients are different day to day," said Rino Nori, 23, a CPA candidate and 1999 graduate of the management information systems (MIS) program at the University of Connecticut. "You need to be someone who likes to do different things constantly and is not pressured by deadlines."

Nori now works for PriceWaterhouseCoopers, one of the nation's largest accounting firms, in a rotating group that exposes young accountants to all types of work including internal audits, mergers and acquisitions, and information systems. So far, he's passed two of the four parts to the CPA exam.

The job, he said, is tough but challenging.

"You can't mind staying 12- or 14-hour days during busy season which is from late January to April as companies file their year-end financial statements," Nori said. "It's rewarding in the end when you know you've done a good job and helped your clients out."

-- Click here to send e-mail to Shelly K. Schwartz

|