Neglected Napster: No buyer in sightThe online music pioneer put itself up for sale in September. So why has there been no talk about a takeover since then?NEW YORK (CNNMoney.com) -- Online music store Napster put itself on the shopping block back in September. But to paraphrase music legends Simon and Garfunkel, Napster investors hoping for news of a takeover have been forced to listen to the sounds of silence. The company announced on September 18 that it had hired investment bank UBS to assist the company in an "evaluation of strategic alternatives," including strategic partnerships or a potential sale.

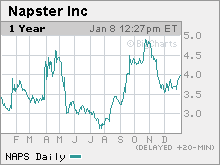

The UBS announcement drove shares of Napster (Charts) 13 percent higher that day. And shares of Napster surged another 22 percent by late October thanks largely to takeover speculation. But Napster's management has steadfastly refused to discuss the status of merger talks, and, as a result, some shareholders are getting nervous. The stock has fallen 20 percent since late October and now trades at about the same price it was at before Napster hired UBS. "Napster is not necessarily in a huge rush to sell, but it obviously wouldn't hurt to hear more about what's happening with a sale. It does concern me a little bit," said Ryan Jacob, manager of the Jacob Internet fund, which owns Napster shares. As of November 30, Napster was the fund's eighth-largest holding. Dana Harris, a spokeswoman for Napster, said the company has no comment whatsoever about the possibility of a sale and that Napster would not provide any updates about the process. But some music industry experts wonder if anyone will want to buy Napster. Napster, which used to be synonymous with illegal file sharing, has reinvented itself as a popular digital music destination that lets consumers have unlimited downloads if they pay a monthly subscription. There is also a free offering that only allows users to stream songs. Despite the growth that services like Napster, Yahoo's Music Unlimited and RealNetwork's Rhapsody have seen, Apple (Charts) remains the clear top dog in online music since its market-leading iPod music player is linked to its iTunes music store. And Napster's music files can't be transferred seamlessly to iPods. Technically, a Napster user can download songs from Napster, burn them to a CD and then copy them into an iTunes library. But that's a step that many users are not willing to take since they could avoid this hassle by just downloading a song from iTunes. And this issue could limit Napster's attractiveness to buyers. "The incompatibility problem has slowed what would have been faster growth for Napster," said Bob Kohn, chairman and CEO of RoyaltyShare, a Web-based royalty processing firm for the music industry. Kohn was a co-founder of eMusic, an online music subscription service similar to Napster that was bought by record label Universal in 2001 and then sold to private equity firm Dimensional Associates in 2003. In fact, Kohn said that a private equity firm, as opposed to another publicly traded company, could make the most sense as a possible acquirer of Napster. Napster would be a relatively small acquisition - it has a market value of about $176 million. Plus, the company has a pristine balance sheet, with $90.3 million in cash and no debt. "A private equity firm with the patience and financing could acquire Napster and wait it out," Kohn said. "Private equity firms don't have to worry about the quarter-to-quarter bottom line." Still, Napster reported some encouraging news about its subscriber growth last week that could be appealing to possible buyers. On Thursday, Napster said that it added 48,000 subscribers in its fiscal third quarter, which ended in December, and that the company finished the quarter with 566,000 subscribers. As a result, Napster said it expected revenue for the quarter to come in above $28 million, slightly ahead of Wall Street's consensus sales estimates of $27.4 million. "The company's indication that both subscriber and revenue growth has improved should help stimulate interest from potential partners. It does show that some of the troubles Napster has faced over the past year have been rectified to at least some degree," said Frederick Moran, an analyst with Stanford Group. Nonetheless, Moran said the number of potential buyers for Napster is probably not as big as once thought. He argues that companies that already have a presence in the online music business, such as Yahoo (Charts) and RealNetworks (Charts), don't need Napster. He adds that other possible suitors probably are scared off by the fact that online music is a highly competitive business and that Napster, despite healthy revenue growth, has continued to report losses. "The digital music download market remains intensely competitive and Napster has not shown anything but losses historically. Those losses probably provide some discomfort for potential buyers of the company," he said. "There is value in Napster, but is it worth the assumption of the losses that it's produced?" Kohn agrees. He said that even well-heeled companies with better-known brand names than Napster have made an attempt to supplant Apple in the digital music business and have so far failed. So buying Napster just to get bigger would not necessarily make sense, he said. "MTV, Microsoft and Virgin are all in the download business and are not bringing in the numbers they'd hoped for," he said. "The quandary for Napster is, it would bring a strategic buyer no added value, so why add all the costs?" Still, Jacob thinks Napster could wind up getting acquired and that, given the stock's recent pullback, a 50 percent premium is possible. That would value Napster, currently trading just below $4 a share, at about $6 a share. Jacob said that there are still plenty of companies, most notably wireless telephone firms, that have expressed interest in music as a growth opportunity. To that end, Nokia (Charts) bought digital music company Loudeye Corp. last year. So a Nokia competitor like Motorola (Charts) or a telecom firm like AT&T (Charts) could make sense as a possible buyer for Napster. "For an equipment vendor or service provider that would like to gain share in music, Napster has the technology and scale to give them a running start," he said. The problem for investors, though, is that at this point, said the Stanford Group's Moran, the only reason to expect a significant move in the stock price is if Napster were to in fact sell out. Napster is expected to report an annual loss of 97 cents a share this fiscal year, which ends in March, and an annual loss of 87 cents a share in fiscal 2008. So buying the stock simply as a bet that Napster will be acquired is incredibly risky. "Investors will need to see a lot more subscriber and revenue progress as well as a minimization of loses in order to get more comfortable with the stock," he said. "Last year's runup in the stock is primarily related to hope that Napster will sell itself so if no deal were to come, the possibility of sinking back to the $3 level exists." Stanford Group's Moran does not own shares of companies mentioned in this piece, and his firm has no investment banking ties with them. |

Sponsors

|