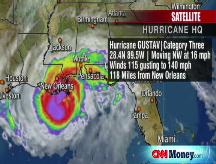

Gustav knocks out Gulf oil production

U.S. Department of Energy says hurricane halted oil and natural gas industry's activities in the Gulf of Mexico.

NEW YORK (CNNMoney.com) -- Hurricane Gustav has shut down nearly all crude oil production and 82% of natural gas production in the Gulf region, according to a Department of Energy report issued Monday.

The department offered a fresh look at the hit the storm delivered to the U.S. oil industry - chronicling an extensive stoppage in refinery output, crude delivery, and production of oil and natural gas.

According to the report, 96.2% of crude oil production has been shut down in the Gulf of Mexico, equal to 1.25 million barrels per day - or 25% of U.S. daily output.

Three oil delivery pipelines in the Gulf have been shut down, totaling 2.6 million barrels of daily capacity.

One expert predicted the industry will be able to absorb the hit to production as long as the storm did not significantly harm the infrastructure.

It's not yet known the extent of the damage to the energy infrastructure that, if any, Gustav has caused. Exxon Mobil (XOM, Fortune 500), BP (BP), Shell (RDSA) and other oil companies said they will begin to assess the damage as soon as it is safe to return to the offshore rigs. Shell predicted Tuesday would be the earliest it could send crews back to its Gulf operations.

"The question is what the damage will be," said Esa Ramasamy, director of market reporting for energy analysis group Platts. "If there's no damage, then you'll see production to come back sooner than expected."

Of 32 Gulf Coast refineries, which process crude oil into usable gasoline, 12 have completely shut down and 10 have reduced activity. The reduction in refinery operations resulted in 5.5 million barrels less daily capacity.

That will mean less gasoline on the market for consumers. But with slumping U.S. demand for fuel, the market may be able to weather the storm.

"Demand has been declining for several months because of high oil prices," said Ramasamy. "Supplies may be a bit tighter because of lower refinery output, but there's still plenty of gasoline on the market to meet demand."

Natural gas production in the Gulf was also severely affected by the storm, 82.2% of which has been shut down, according to the survey. That's equal to 6.1 million cubic feet per day of reduced activity.

Of the 22 natural gas pipelines in the gulf, 19 have stopped operating.

"The problem is that the logistics of delivering the oil has been shut too," said Ramasamy. "If the inspectors find damage, shipments may not even start up this week, which would result in more production loss." ![]()