Buffett bank favorite gets bigger

U.S. Bancorp, a top holding of Warren Buffett's Berkshire Hathaway, is taking over a large failed bank. If the Oracle of Omaha is a fan, should you be buying?

NEW YORK (CNNMoney.com) -- U.S. Bancorp is probably the biggest bank you've never heard of. But there are two reasons why you might want to start paying attention to it.

It is about to get bigger and it's also a favorite investment of some guy in Omaha whose name you probably do know: Warren Buffett.

On Friday, U.S. Bancorp agreed to buy the nine banks that were part of FBOP, a privately held multibank holding company that failed and was seized by the FDIC.

As a result of the deal, U.S. Bancorp will add $18.4 billion in FBOP's assets and 150 branches spread throughout California, Illinois, Texas and Arizona. This acquisition is U.S. Bancorp's fourth purchase of a failed bank or savings and loan since last November. Including FBOP, U.S. Bancorp has added nearly $35 billion in assets and about $27.7 billion in consumer deposits.

Still, U.S. Bancorp (USB, Fortune 500) doesn't get nearly the attention that other big banks receive, despite the fact that it has $265 billion in assets and is the sixth-largest commercial bank in the country.

While its bigger rivals JPMorgan Chase (JPM, Fortune 500), Citigroup (C, Fortune 500), Bank of America (BAC, Fortune 500) and Wells Fargo (WFC, Fortune 500) were all singled out to receive $25 billion in "rescue" money as part of the first installment of TARP funds last fall, U.S. Bancorp had to wait and apply for TARP just like other smaller banks.

It received $6.6 billion in bailout funds last year but it also was one of the first big banks to return taxpayer money.

In June, U.S. Bancorp was one of 10 banks that took part in regulators' stress tests earlier this year that was given a relatively clean bill of health.

That might be one reason why Warren Buffett is such a big fan of U.S. Bancorp. As of June 30, Buffett's Berkshire Hathaway (BRKA, Fortune 500) owned 69 million shares in the bank, a 3.6% stake. That makes Berkshire the fourth-largest owner in U.S. Bancorp. What's more, U.S. Bancorp is Berkshire's tenth-biggest holding.

The bank has held up remarkably well during the credit crisis and recession. It has posted a profit in each of the past five quarters.

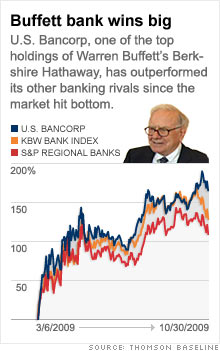

And the stock, like that of other Berkshire bank holdings such as Wells Fargo and Buffalo's M&T Bank (MTB), has responded to the relatively strong results. The stock has more than doubled since the market hit its low point of the year in early March, outperforming the big gains at many of its regional bank rivals.

Investors appeared to like the news of the FBOP (not to be confused with the annoying Hanson song MMMBop from a decade ago) acquisition as well. The stock was up about 2% in midday trading Monday.

So if Warren Buffett thinks so highly of U.S. Bancorp, does it make sense for your portfolio. It might. The stock does trade at a higher valuation on both a price-to-earnings and price-to-book value basis than many other large regional banks.

But Frank Barkocy, director of research with Mendon Capital Advisors, an investment firm that focuses mainly on financial stocks and owns shares of U.S. Bancorp, said the stock is worth it.

"The stock does sell at a premium to the banking group and that might frighten some investors away but we think it's one of the better managed financial institutions out there," Barkocy said. "You get what you pay for. U.S. Bancorp is a consistent quality performer."

Barkocy added that the purchase for FBOP will give U.S. Bancorp a small, but important, foothold in Texas. It is taking over three branches in the Lone Star State as a result of the deal.

That obviously isn't a whole lot right now but it could allow U.S. Bancorp to expand more in Texas, which is a key banking market that has not been hit as hard as the rest of the country during the wave of bank failures over the past two years.

Of course, the bank is not perfect. It's a bank after all. U.S. Bancorp reported last month that its non-performing loans and net charge-offs tied to bad loans rose in the third quarter.

But the pace of loans going sour is starting to slow. That's a good sign. And U.S. Bancorp's credit quality has been much higher throughout the credit crisis than most of its peers.

As of the end of September, non-performing assets made up 2.4% of total loans. By way of comparison, the non-performing asset to loan ratio for Bank of America was 3.7% in the third quarter.

"Part of the dilemma with banks is there a degree of the numbers being a black box. But U.S. Bancorp didn't wind up with as much junk in their portfolio. That intrigued us," said Don Yacktman, manager of the Yacktman fund and Yacktman Focused fund. U.S. Bancorp is a holding in both funds.

Add all that up and it shows that not all banks mucked it up royally during the housing boom and resulting bust. Some banks have somehow managed to continue growing without taking on ridiculous levels of risk.

So it looks like there's a good chance U.S. Bancorp will continue to impress Buffett and the rest of its shareholders.

Talkback: Do you think it makes sense to follow the investing advice of Warren Buffett? Share your comments below. ![]()