Search News

Click the chart for more market data.

Click the chart for more market data.

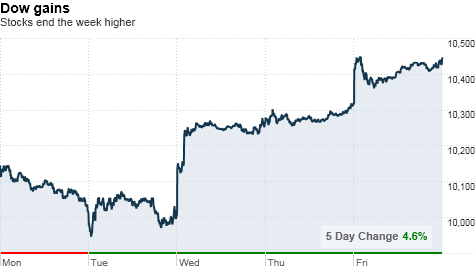

NEW YORK (CNNMoney.com) -- Stocks closed near session highs Friday, with the Dow erasing its losses for the year, as investors welcomed a better-than-expected report on the U.S. job market.

The Dow Jones industrial average (INDU) rose 128 points, or 1.2%. The S&P 500 (SPX) gained 14 points, or 1.3%, and the Nasdaq (COMP) composite rose 33 points, or 1.5%.

The rally pushed the Dow back into the black for the year. At roughly 10,448 points, the index is up nearly 0.2% since it closed at 10,428 points on Dec. 31.

All three major gauges ended the week with gains. The Dow added 2.9% this week, while the S&P 500 rose 3.7%, and the Nasdaq advanced 3.7% over the last five days. It was the first weekly gain for all three gauges in three weeks.

The advance was broad-based. Caterpillar (CAT, Fortune 500) and Boeing (BA, Fortune 500) led gainers on the Dow, in what was a solid week for industrial names. But shares of consumer-linked stocks, Coca Cola (KO, Fortune 500) and McDonalds (MCD, Fortune 500), weighed on the blue-chip index. Telecoms AT&T (T, Fortune 500) and Verizon (VZ, Fortune 500) lagged, while tech bellwether IBM (IBM, Fortune 500) added over 2%.

The better-than-expected jobs report, which came on the heels of improved manufacturing data earlier in the week, helped ease some concerns about the economy. But a report on activity in the services sector came in weaker than expected.

Meanwhile, yields on U.S. Treasury bonds and notes rose as demand for safe-haven assets waned. Gold prices fell.

"It's all about the payrolls number," said Tom Schrader, managing director at Stifel Nicolaus.

While the jobs data suggests the economy could avoid a "double-dip" recession, he said investors remain nervous about the outlook for short-term growth. In addition, concerns about growth in China and lingering debt problems in Europe also continue to weigh on the market.

"There's still a lot to worry about," Schrader said.

Trading volume was light with many market participants on vacation. On the New York Stock Exchange, advancers beat decliners by roughly two to one on volume of about 1 billion shares.

Looking ahead, there are relatively few economic reports for investors to digest next week and one fewer trading day on the calendar. U.S. markets will be closed Monday for the Labor Day holiday.

Stocks had ended higher Thursday as investors cheered strong sales results from major retailers and better-than-expected reports on pending home sales and jobless claims.

Economy: The government's widely anticipated jobs report showed that the U.S. economy lost jobs for a third straight month in August, but employers cut fewer positions than economists had forecast.

The economy lost 54,000 last month. That compared with 131,000 jobs shed in July. Economists were expecting employers to slash 121,000 positions in August.

The private sector added 67,000 jobs, beating economists' expectations for a gain of 44,000. The unemployment rate ticked up to 9.6%, from 9.5% in July, in line with expectations.

"Payrolls continue to be added in the private sector, but at a painfully slow pace," said Jim Baird, chief investment strategist for Plante Moran Financial Advisors. "Companies remain in a preservation mode and have continued to seek out alternative ways of increasing production."

Meanwhile, the Institute for Supply Management's (ISM) services index slipped to 51.5 in August from 54.3 in July. Economists had forecast a decline to 53, according to consensus estimates from Briefing.com.

World markets: European shares closed higher. The CAC 40 in France rose 1.2%, the DAX in Germany gained 0.8%, and Britain's FTSE 100 gained 1%.

Asian markets ended mostly higher. Japan's benchmark Nikkei index rose 0.6%, and the Hang Seng in Hong Kong added 0.5%. The Shanghai Composite ended unchanged.

Currencies and commodities: The dollar fell against the euro and the British pound but was higher versus the Japanese yen.

Oil futures for October delivery fell 64 cents to $74.38 a barrel. Gold for December delivery fell $2.30 to $1,251.10 an ounce.

Bonds: The yield on the 10-year Treasury note rose to 2.71% from 2.61% late Thursday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |