Search News

The commodities boom is helping to lift profits for materials and energy firms -- as well as the overall market. But other sectors aren't growing as fast.

NEW YORK (CNNMoney) -- Investors are obsessing about Greek debt and the end of the Fed's QE2. But by the end of next week, those two stories may be soooo last month. So June.

Yes, the second quarter ends a week from Thursday. That means it's time to start wondering just what second-quarter corporate earnings, and more importantly, guidance for the last half of the year, will be like.

The semi-official start to the earnings deluge doesn't begin until July 11, when Dow component Alcoa (AA, Fortune 500) reports its results.

But other prominent companies, whose fiscal years don't correspond with the Gregorian calendar, have already started to give a glimpse of how profits are shaping up. And guess what? They're actually quite good.

FedEx (FDX, Fortune 500) reported earnings and sales for its fiscal fourth quarter (which ended in May) on Wednesday that topped analysts' estimates.

Even better, the shipping giant issued a healthy earnings outlook for the next quarter and full year. Shares of FedEx rose about 3% on the news while rival UPS (UPS, Fortune 500) was up 1%.

Supermarket chain Kroger (KR, Fortune 500), athletic apparel maker Lululemon (LULU) and fertilizer producer Agrium (AGU) have all given solid earnings forecasts as well in the past few weeks.

Oracle (ORCL, Fortune 500) reports its latest results after the closing bell on Thursday. And if recent history is any indication, the software titan will probably beat analysts' consensus projections.

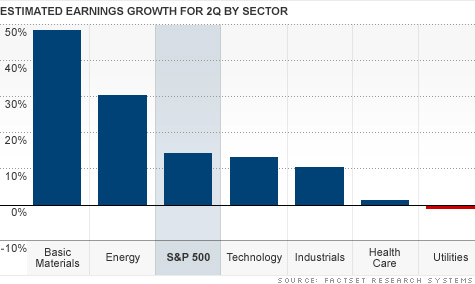

Overall, second-quarter earnings are expected to be fairly robust. According to data from FactSet Research Systems, profits for the S&P 500 should be up 14% from a year ago.

What's more, sales are expected to be up more than 10%. That's a good sign. It shows that companies are once again making money because of real demand for their products and services as opposed to slashing costs, like those pesky worker salaries, to preserve profit margins.

The financial sector is the exception to the rule though. As I pointed out in Tuesday's column about big banks, financials should post strong profit increases but revenue growth is expected to be the slowest of all 10 sectors.

Looking at the rest of the market, the surge in commodity prices is helping to lead overall profits higher. Basic materials and energy companies are expected to post the strongest levels of year-over-year growth.

Healthcare and utilities -- the only sector expected to report a decline in profits -- are the notable laggards.

Still, there are many reasons to be concerned. There appears to be a disconnect between forecasts for the U.S. economy, which are getting worse, and earnings estimates, which are getting better.

"With the economic numbers that have been coming out, you might think that earnings numbers would come down for the third and fourth quarter but they haven't yet," said John Butters, senior earnings analyst with FactSet in Boston.

As I've pointed out extensively in the past few months, many CEOs have talked a good game about how well they think their own company is doing. But they aren't backing up this confidence by hiring more. That's troubling.

"Companies feel more negative about the overall economy but they are still cautiously optimistic about their own business," said Walter Owens, head of U.S. commercial banking with TD Bank in Cherry Hill, N.J.

That could be a sign that overall earnings estimates are too high. If all the houses next to yours are on fire, would you feel confident staying put just because your house isn't currently on fire?

Some companies may get hit by all the global turmoil in the second quarter.

Software firm Adobe (ADBE), for example, said sales in Europe were sluggish when it reported earnings after the bell Tuesday. Its stock tumbled 6% on the news. And the lingering effects of the Japan earthquake was a top reason why chip company Texas Instruments (TXN, Fortune 500) cut its forecasts earlier this month.

It's also worth noting that profit margins have been extremely strong lately. It's possible that margins have peaked and there may be nowhere to go but down.

"I am in a perpetual state of nervousness. Profit margins are close to record highs and the question is can they be maintained?" asked Paul Nolte, managing director of Dearborn Partners, an investment firm in Chicago.

So while there is a lot to be encouraged by as companies get set to report earnings, there's still a lot to keep investors on edge as well.

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: