Search News

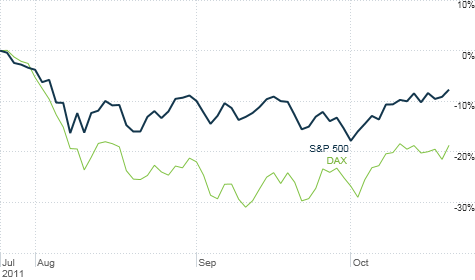

Europe sneezes and ... well, you know the rest. U.S. stocks have mirrored the developments out of Germany, France and the rest of the EU for the past few months.

NEW YORK (CNNMoney) -- Who said investing was hard?

All you need to do these days is wake up in the morning, follow what European stocks are doing and pay attention to all the latest chit-chat about what Angela Merkel and Nicolas Sarkozy allegedly said to each other during their latest emergency phone call.

Easy peasy.

I've been covering the markets for 16 years and I cannot remember a time when what was going on in the United States mattered so little. (I tweeted yesterday that the U.S. is now the Jan Brady of global economies to the EU's Marcia. "Europe! Europe! Europe!")

Just look at the chart at the top of this page. The swings in the S&P 500 (SPX) may not be as dramatic, but the moves clearly mimic what the DAX (DAX) in Germany is doing.

Bad earnings from some of the banks? Who cares? What's the latest speculation on how big the European Financial Stability Facility really needs to be?

Did Ben Bernanke just say something? Yawn. Someone just blogged that Italian bond yields are soaring again because of rumors that UniCredit may have to take a bigger haircut on Greek debt.

The U.S. market tanked during the summer because of worries about the lack of a plan by the European Union, International Monetary Fund and European Central Bank to save Europe.

And now the market is surging during "Rocktober" (S&P 500 is up more than 9%!) because there are hopes that the troika we've all come to know and love may finally announce a plan to rescue Greece and solve the debt crisis. For reals this time. We mean it! No later than next week! Or early November?

The Europe obsession is going to last for at least a few more weeks. And for good reason. If the EU cannot get its act together and the problems in Greece spill over to the rest of the continent, that is not good news for the U.S. at all. To start, the impact on U.S. banks could be disastrous.

But if the troika does come out with a reasonable plan -- which is clearly what the market is betting on right now -- the October rally could very well continue for the next few months.

"The progress in Europe has been painfully slow but it seems like European leaders are coming to the conclusion that the rescue fund has to be increased in size and steps have to be taken to recapitalize the banks," said Alan Skrainka, chief investment officer with Cornerstone Wealth Management in St. Louis. "I think Europe is finally taking this more seriously."

As such, sentiment seems to have shifted. Instead of fearing the worst, bulls are hoping for, if not necessarily the best, something that isn't absolutely horrendous.

"There is a certain element of panic buying going on," said Bruce McCain, chief investment strategist with Key Private Bank in Cleveland. "If Europe doesn't blow up, investors may be positively surprised. Right now, it's more a matter of avoiding huge disappointments."

That may be true. But given how sharply stocks have rebounded from their summer slump, I'm not convinced that all Europe has to do is not implode to satisfy investors.

You can easily make a case for a classic "sell the news" dumping of stocks once we finally have a concrete plan to digest as opposed to the dribs and drabs we keep getting through the rumor mill. And remember, there still isn't an official, definitive plan.

"European leaders are still wrangling over how to get more firepower out of the bailout fund," said Paul Christopher, chief international strategist with Wells Fargo Advisors in St. Louis. "Some want to use it as an insurance fund. Some want to turn it into a bank. Germany and France are still going back and forth."

Christopher pointed out that the market seems to be ignoring the fact that forcing European banks to take deeper discounts on their Greek debt holdings while also requiring them to be recapitalized are "mutually contradictory goals." He added that it's still not certain that Europe will be able to avoid a worst-case scenario of an abrupt Greek default.

Graham Summers, chief market strategist with Phoenix Capital Research in Charlottesville, Va., agreed. Summers worries that this month's rally will be short lived. He thinks that even if the EFSF gets increased to several trillion euro, it still may not be able to stop an eventual Greek default or be enough to prevent things from getting worse in debt-laden Spain and Italy.

"It's pointless. It's just one massive verbal intervention after another. Unless aliens come down from the sky dropping money, you can't keep all the bailouts going," Summers said.

Reader comment of the week. I wrote a lot about the big banks this week in light of Occupy Wall Street and earnings from the likes of Bank of America (BAC, Fortune 500), Citigroup (C, Fortune 500) and Goldman Sachs (GS, Fortune 500).

There was a lot of Twitter chatter about the fact that many banks were able to benefit from a little thing called DVA, essentially a quirk that lets banks mark the current discounted value of their debt to market as a profit.

That led to the following tweet from Scott Williams, aka @inklingsw. I listened to the #BAC conf call - was that "$6.2 billion on accounting games" or "gains" it was a little early..."

Nice one. Anyway, The Buzz is taking Monday and Tuesday off. I'll be back Wednesday. Sadly, I'll miss weighing in on what could be a very interesting earnings report from Netflix (NFLX) Monday. Oh well. But I'm sure that whatever they announce Monday they'll abandon on Wednesday, right?

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: