Search News

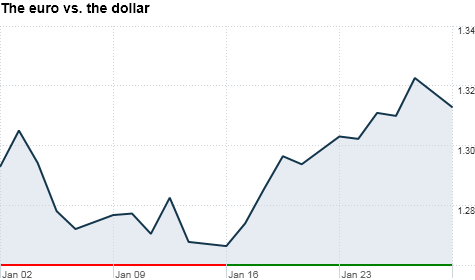

The euro has enjoyed a nice rally against the dollar in the past few weeks and is now up versus the greenback for the year. Click the chart for more on currencies.

NEW YORK (CNNMoney) -- Maybe the euro isn't doomed after all?

The currency has gained nearly 4% over the past two weeks against the dollar, despite the fact that European leaders still haven't come up with a definitive plan to resolve the continent's nagging fiscal crisis.

There isn't even a firm agreement between Greece and investors on how to restructure Greek debt. But if there was an exchange-traded fund for EU summits, that would be at a 52-week high.

Why has the euro rebounded so sharply? Part of it is due to increased optimism (Yes. Optimism.) about Europe.

While Greece is still a wild card and Portugal is looking problematic again, investors have been heartened by solid demand for bonds sold by Italy and Spain. That has pushed borrowing costs for the two biggest components of Europe's PIIGS (Ireland is the other I in case you forgot) down considerably.

It seems the European Central Bank's decision last month to allow banks to take out three-year loans for 1% is helping the most troubled European nations sell their own debt. The rationale for the ECB's program was that banks would use the loans to buy sovereign debt. That appears to be happening.

But experts said the euro rally may not last.

"Investors may be getting ahead of themselves if they were buying euros on hopes that Greek debt talks will be resolved or that Italian and Spanish bond yields are now sustainable," said Rob Robis, senior portfolio manager with the ING Global Bond Fund (INGBX) in Atlanta.

Robis said it would be a mistake to label the recent rebound in the euro as a real sign of strength. It may be more an indication of dollar weakness, so to speak.

The Federal Reserve announced last week that it would likely keep its key short-term lending rate near zero until the end of 2014. Previously, the Fed had pledged to leave rates this low until mid-2013.

Low interest rates are like Kryptonite to a currency. So the news that the Fed was probably going to hold steady for a longer period of time helped temporarily juice the euro as well.

But Andrew Busch, global currency and public policy strategist with BMO Capital Markets in Chicago, said it's important to remember that the ECB is likely to follow the Fed's lead with low rates for a long time. The E stands for European, but it might as well stand for Easy.

The ECB has already cut rates to 1% in the wake of the crisis. Busch expects rates to head even lower before long. That should eventually lead to another round of euro selling.

"We may have already seen the low for the euro this month or even this quarter. But it doesn't take away the fact that the ECB will have to lower rates again," Busch said. "This is probably not the low on the euro for the year."

It would be great news for the global markets if we finally get to a point where investors don't have to be so fixated on Europe. But we aren't that there yet.

In the best case scenario, there is continued improvement.

Bond yields in Italy and Spain continue to fall and pressures ease in nations like France and Belgium too. Greece and its creditors finally reach a deal and even if Greece still winds up defaulting, it's done in an organized way. Portugal moves back from the brink.

But even if this pans out, investors still don't have much to like in Europe. Economic growth will be sluggish (if there is even growth) due to necessary austerity measures.

"The problems that got Europe into this have not gone away. You probably should be still selling euros on rallies," Robis said.

And some experts still fear the worst.

Jamie Coleman, chief currency analyst at ForexLive in Boston, said he pegs the chances of Greece having to drop the euro currency at 50/50. He worries that Portugal, which now has a 10-year bond yield that tops 17%, could lead to more trouble for the rest of Europe.

"Greece is a black hole. They can shuttle money in but there is still no end in sight to the problems. It looks like Portugal is going down that same road," Coleman said. "If Portugal follows the same route as Greece, it will be difficult to say that's the end. The contagion would be difficult to contain."

Best of StockTwits: If you don't have Facebook fatigue yet, you likely soon will. The report in the Wall Street Journal about a possible IPO filing this week has many excited.

Shares of fellow social media companies Zynga (ZNGA), Groupon (GRPN), LinkedIn (LNKD) and Pandora (P) all popped Friday afternoon on the report. So did Facebook investors GSV Capital (GSVC) and the closed-end Firsthand Technology Value Fund (SVVC).

But not everyone "likes" Facebook or the companies riding the Facebook tide.

AronPinson: To all those chasing $GSVC... (All else equal...) Even if $FB tripled to $100 a share, $GSVC's NAV would only go up to $17.76.

Great point. GSV is currently trading at $17 and change. Shares are up nearly 25% already this year. There may be some "irrational exuberance" here. For more, check out my colleague Julianne Pepitone's piece on GSV last month.

johnwelshtrades: Hoping the $FB (Facebook) IPO can pop $GRPN & $ANGI. Let's get these two slobs high in price for better shorting.

Heh. Smaller social media companies -- particularly ones like Groupon that are, to be nice, profit-challenged -- probably don't deserve to go up merely because Facebook is finally going public. So be skeptical of any price bumps that second-tier social companies get in the wake of Facebook.

alexheimann: $FB ads are worth less than Google CPC and Google CPC are slowing down , so how will $FB justify that valuation.

Some might argue Facebook's emergence is a key reason why Google's (GOOG, Fortune 500) cost-per-clicks (CPC) are going down. Mobile ads probably have something to do with it too. But I agree Facebook will have a lot to prove. It may not really deserve to be worth $100 billion right out of the gate given that it will likely depend on the whims of fickle advertisers for the foreseeable future.

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: