Search News

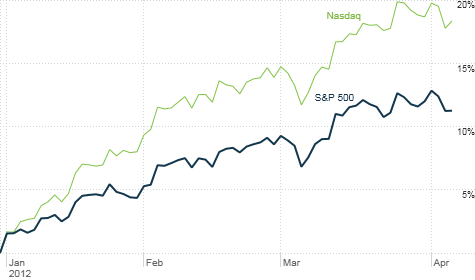

Despite a mild sell-off so far in April, stocks are still off to a scorching start for 2012. A healthy correction may be looming.

NEW YORK (CNNMoney) -- Sell in May and go away? If this market slump continues, traders might need to rename the phrase. Sell in April and hide under the table, perhaps?

After a scintillating first quarter, stocks have pulled back this week for several reasons.

There are concerns that the Federal Reserve may not come to the market's rescue with another round of quantitative easing. There are also renewed worries about Europe's debt crisis after a disappointing bond auction in Spain. Fears of a hard economic landing in China aren't helping either.

But let's be honest. A deeper sell-off for stocks, even if it is painful in the short-term, might be needed.

Momentum stocks in particular appear to have gotten ahead of themselves. The Nasdaq was up nearly 19% in the first quarter! That's a great return for a full year. And so far, the market's recent declines have been relatively mild -- which means there could be more downside ahead.

Even though the Nasdaq fell more than 1% Wednesday and has fallen in six of the last seven trading days, the tech-heavy index is still only down about 1.8% in the past two weeks. A true correction would need to be about 10% off the recent highs.

Stocks may not fall that much. But would a pullback of about 5% be all that shocking? Not really.

"It won't be a dramatic correction. But we do need a rest," said Doug Ober, CEO of Adams Express (ADX), a closed-end fund in Baltimore that invests in U.S. stocks.

Investors have to keep in mind that companies are about to start reporting first quarter earnings. This may spark a bigger sell-off in the next few weeks. Unless your name is Apple (AAPL, Fortune 500), results may not be much to write home about. Earnings for the S&P 500 are actually expected to decline from a year ago.

"If profit reports are worse than expected, that could create a downward spiral for stocks," said Andrew Fitzpatrick, director of investments with Hinsdale Associates in Hinsdale, Ill.

Still, few are expecting a bloody market rout like 2008. Fitzpatrick said that if stocks do pull back, he'd be looking for bargains. A mild sell-off would be healthy.

"The rally can't continue at this pace for the rest of the year. This may be the start of a breather. I would not be surprised by a 3% to 5% drop at all," he said. "But that would be more of a buying opportunity than a cause for concern."

Simply put, shares of quality U.S. companies should continue to do well as long as the economy continues to improve. This may not be the strongest of recoveries, but it is still a recovery.

Many investors that are still clinging to bonds may need to reevaluate their position if growth continues to pick up.

"We were due for a pause in stocks. And I know there is still a lot to worry about," said Jeffrey Saut, chief investment strategist for Raymond James in St. Petersburg, Fla. "But once the world realizes we are not going to slip in to another recession, more money will shift out of fixed income and into U.S. equities."

And despite the big run-up in stocks this year, many blue chip stocks are still trading at attractive prices.

Apple is trading at just 14 times fiscal 2012 earnings estimates. Google (GOOG, Fortune 500), Microsoft (MSFT, Fortune 500) and IBM (IBM, Fortune 500) are among the many mega caps also trading at price-to-earnings multiples in the low to mid teens based on this year's profit forecasts.

That's a big difference between now and the late 1990s and early 2000s, a time when some market leaders were trading at triple-digit P/E ratios.

"Longer-term, when you look at valuations and the fact that the U.S. economy is growing, it's hard to make a strong case against stocks," said John Norris, managing director of wealth management with Oakworth Capital Bank in Birmingham, Ala.

But Norris was quick to add that investors have to dial back their expectations for the rest of the year and not get too greedy. He's not alone. According to the most recent CNNMoney survey of market strategists, the consensus target for the S&P 500 at the end of 2012 is not much higher than current levels.

"The first quarter, was of course, very nice. But how much longer can this last?" Norris said. "If we are flat for the rest of the year, I'll take it."

Best of StockTwits: Shop till you drop. Some may write it off to unusually warm weather or a stronger dollar versus the euro. But many U.S. retailers enjoyed solid same-store sales gains in March.

retail_guru: US #retail Mar comps were terrific, esp for apparel players; with fewer promos, earnings upside is coming $LTD $JWN $M $WSM $TGT

CNBCMelloy: #BUYAMERICAN Blowout early spring sales, strong dollar playing right into retail sector's hands $RTH $M $TGT $GPS (not for multinationals)

Healthy sales for Macy's (M, Fortune 500), Target (TGT, Fortune 500) and others could be a good sign for consumer spending and the broader economy. But for retailers to remain on a hot streak, we need to see even more jobs growth. Hopefully, we'll get that tomorrow.

CreateCapital: $BBBY is the GREATEST discretionary income sucker in retail. Great operation, great mgt...

Very true. You don't have to be Frank the Tank to love this store. But don't mistake Bed Bath and Beyond's (BBBY, Fortune 500) strength for a sign of a rebound in housing.

I wrote a few weeks ago about how BBBY is curiously a member of a key homebuilder ETF (XHB). But this retailer may be doing well because more people are looking to stay in and improve their current homes as opposed to buying new ones.

stephanie_link: a rare miss from $COST-first time in a year it didn't beat consensus. ex-gas comps rose 5% vs 6% expected. traffic also at low end at 3.5%.

That is interesting. Costco (COST, Fortune 500) has thrived during this tepid recovery. Is it possible that consumers are slowly becoming less budget-conscious as the economy shows some signs of life?

No Best of StockTwits or Reader Comment of the Week tomorrow since A. the market is closed; and B. it's been a short week for me. But I will have a Buzz column tomorrow about the jobs report. For those of you not working tomorrow, enjoy the long weekend.

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: