Search News

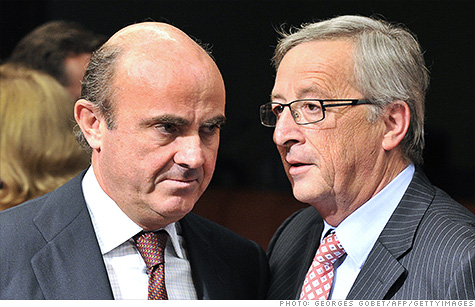

Spanish Finance Minister Luis De Guindos speaks with Eurogroup president Jean-Claude Juncker before an eurozone meeting in Brussels.

NEW YORK (CNNMoney) -- Europe has a lot riding on its latest tool to stabilize the euro currency union, but there are now more questions than answers about the European Stability Mechanism.

The ESM is a permanent bailout fund that will have a maximum lending capacity of €500 billion. It is designed to replace the European Financial Stability Facility, which has backed bailouts for Greece, Portugal and Ireland.

Some eurozone politicians had said the ESM would be in effect Monday, but the treaty has yet to be ratified by all 17 euro area governments.

The German Constitutional Court is expected to weigh in on the legality of the ESM sometime this week, after the nation's parliament approved the treaty earlier this year. The Italian parliament has yet to ratify the treaty.

The ESM is central to plans European Union leaders announced late last month to break the "vicious circle" between banks and governments, which threatens to bring down one of the region's largest economies.

But there appears to be some disagreement over exactly what the ESM will be able to do, particularly when it comes to buying government bonds and bailing out banks. It is also unclear whether the ESM has enough money to achieve all of its goals.

The Eurogroup of eurozone finance ministers agreed late Monday on the terms of a rescue program for Spanish banks.

The deal needs to be approved by the parliaments of all 17 eurozone nations, but Eurogroup president Jean-Claude Juncker said he hopes an initial €30 billion installment will be made by the end of the month.

Since the ESM does not exist yet, the EFSF will provide the initial funds, said Juncker. The money will go to Spain's bank bailout fund, which means the debt will not fall on the government.

The concern is that the deal will run into resistance as it works its way through eurozone parliaments. Some politicians in more fiscally conservative nations have called for the Spanish government to guarantee the bailout loans, shifting the debt back onto Madrid's balance sheet.

"The credibility of the rescue package for Spain has been called into question even before the loans have been disbursed," said Nicholas Spiro, director of London-based consultancy Spiro Sovereign Strategy.

In addition to recapitalizing banks, EU leaders agreed last month to give the ESM more flexibility to intervene in the sovereign debt market.

The goal is to ease borrowing costs for euro area governments undertaking economic reforms. But it remains to be seen if the ESM is large enough to effectively backstop the bond markets in Spain and Italy.

While it will eventually have up to €500 billion to lend, the ESM will not have all of its "paid-in" capital on day one.

Under the treaty, the ESM will have €80 billion in cash, which eurozone governments will provide in €16 billion installments over the next few years. The remaining €420 billion will be "callable," meaning it will be paid as needed.

"Unfunded stability funds are baloney," said Carl Weinberg, chief economist at High Frequency Economics, a research firm in Valhalla, NY.

Even with its full firepower, the ESM is "woefully inadequate," said Spiro.

The ESM's €500 billion is roughly equal to one-sixth of the outstanding bonds issued by Spain and Italy, he said. "It would struggle to defend Spain, let alone Italy."

What's more, much of the ESM's resources have already been committed.

The ESM will ultimately take over responsibility for recapitalizing Spanish banks, which could cost up to €100 billion. It will also back a second €130 billion bailout for Greece, along with the International Monetary Fund. The bailout for Cyprus could drain another €5 billion to €10 billion.

One big concern is that Spain will be forced to seek a bailout similar to those given to Greece, Portugal and Ireland. While the government's debt load is relatively small, the fear is that Madrid will ultimately pay the price for the nation's banking crisis.

That could cost the ESM another €200 billion, which is roughly how much debt Spain owes in the bond market, said Christian Schulz, a London-based economist at Berenberg Bank.

Given all of these obligations, "the ESM is clearly too small," said Schulz.

However, increasing the ESM's resources is unlikely to happen for political and economic reasons.

Germany, the largest and strongest eurozone economy, is reluctant to put more money into the pot.

In addition, raising the ceiling on the ESM could hurt the credit rating of the eurozone's second-largest economy, France. That, in turn, would undermine the ESM's rating.

The limited nature of the ESM could end up doing more harm than good, said Schulz. If investors believe the fund is capped, they will attempt to unload all of their Spanish and Italian bonds on the ESM, resulting in an even bigger sell-off, he warned.

Overall, analysts say the European Central Bank is the only institution with the financial strength to restore confidence in the bond markets. But ECB president Mario Draghi has said repeatedly that governments are ultimately responsible for solving the underlying economic problems in the euro area. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: