World markets were mixed Monday, as investors focused on the upcoming international economic meeting in Switzerland and U.S. markets were closed for the Martin Luther King Jr. holiday.

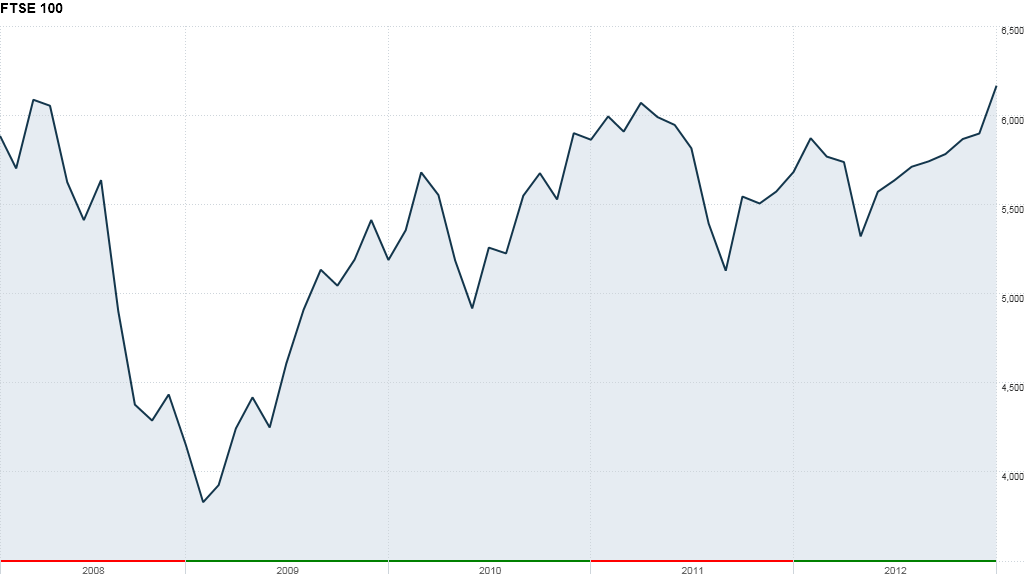

London's FTSE 100 edged up 0.4% to close at its highest point since 2011. The CAC 40 in Paris gained 0.5% and the DAX in Frankfurt rose 0.6%.

Deutsche Bank economist Jim Reid said traders and economists are focused on the five-day World Economic Forum, which begins in Davos, Switzerland, on Wednesday. That's also the same day that the International Monetary Fund publishes an updated outlook on the worldwide economy.

European finance ministers are also holding a two-day meeting ahead of Davos.

The euro slipped against the U.S. dollar, but the change was nearly imperceptible. After gaining nearly 10% during the past six months, the euro "has been confined to an exception[ally] narrow range," said Brown Brothers Harriman currency strategist Marc Chandler.

In the United States, President Obama celebrated his inauguration Monday, a day after he and Vice President Biden were officially sworn in to their second terms during a private ceremony.

Related: Investors brace for deluge of tech earnings

Asian markets were choppy Monday. The Hang Seng in Hong Kong closed slightly lower, while the Nikkei in Tokyo slid 1.5%.

The Bank of Japan began a two-day monetary policymaking meeting Monday, the first under newly installed Prime Minister Shinzo Abe. The central bank is expected to take measures to keep inflation in check. The yen has weakened more than 14% against the dollar since the beginning of October, and many expect that weakness to continue. But the Japanese currency showed signs of life on Monday, gaining 0.4% against the U.S. dollar.

Abe advocates "unlimited" buying of government bonds and wants to see the central bank raise its inflation target to 2%. It is not yet clear whether the BoJ will yield to Abe's wishes.

Related: Japan unveils $117 billion stimulus package

"Uncertainty remains as to the changes to the BoJ's inflation goal, which is currently at 0% for the medium term and 1% over the long term," wrote Camilla Sutton of Scotia Bank in a research note Monday. "The BoJ is expected to pursue a more aggressive stance of monetary policy, likely to result in continued expansion of the central bank's asset purchase program."

-- CNN's Pamela Boykoff contributed reporting.