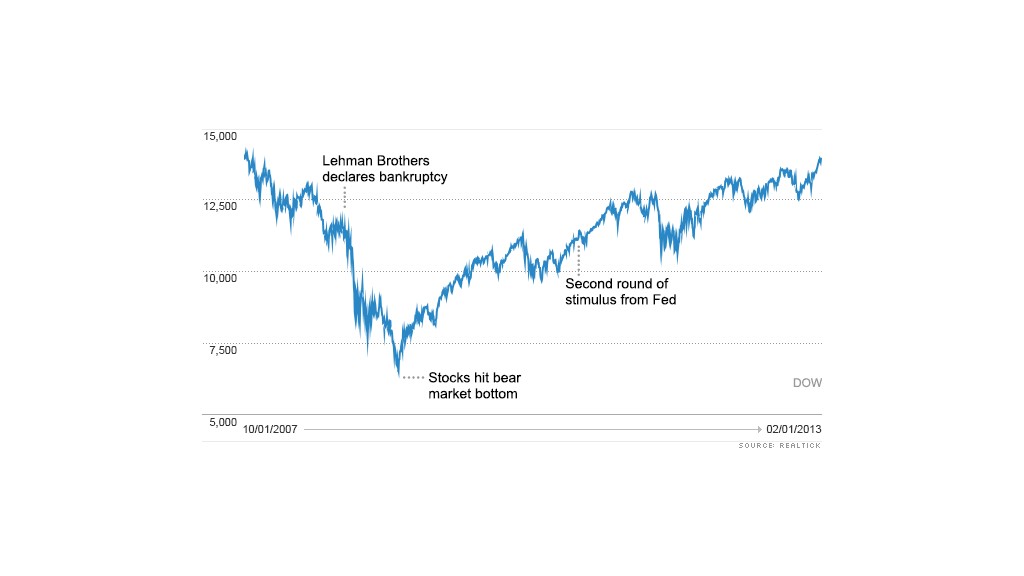

U.S. stocks rallied Friday, with the Dow closing above 14,000 for the fist time since October 2007, as investors welcomed a batch of strong economic data.

The Dow Jones industrial average jumped more than 149 points, or 1.1%, to hit 14,009.8, its highest closing level since Oct. 12, 2007. The Dow is now less than 200 points from its all-time high of 14,198.10.

The S&P 500 rose 1% and is also at its highest level since 2007 -- about 4% away from its record high. The Nasdaq gained 1.2%.

Despite the day's big gains, stocks ended modestly higher for the week. The Dow gained 0.8%, the S&P 500 increased 0.6% and the Nasdaq climbed 0.9%.

Friday's strong advance followed reports on the job market, the manufacturing sector, construction spending and consumer sentiment, which all pointed to a healthy economic recovery.

Related: What's behind the bull market

The U.S. economy added 157,000 jobs last month, fewer than the 180,000 economists were expecting, but investors were encouraged by the government's revisions to its 2012 data. The revisions showed that the economy added 335,000 more jobs in 2012 than originally reported.

"The revisions point to a fairly healthy 181,000 per month trend in 2012, which is more than strong enough over time to bring down the unemployment rate," said Jim O'Sullivan, chief U.S. economist at High Frequency Economics.

In January, however, the unemployment rate ticked up slightly to 7.9% from 7.8% in December. Economists were expecting it to edge lower.

The stalled unemployment rate is "giving strength to the argument that the Fed will continue its bond buying program and keep rates low, which is also a positive for the stock market," said Tom Schrader, managing director at Stifel Nicolaus.

The Fed's commitment to low rates is also boosting the bond market, added Schrader. The price of the 10-year Treasury rose, pushing the yield to 1.96%, down from 1.98% late Thursday.

Meanwhile, the Census Bureau said that construction spending rose 0.9% in December, which was well above expectations.

The Institute for Supply Management's monthly manufacturing index rose to 53.1 in January, a sign that manufacturing sector is continuing to expand. Economists were expecting a reading of 50.5.

The University of Michigan's sentiment index rose to 73.8 in January. Economists were expecting a reading of 71.4.

Related: Fear & Greed index ticks lower, but still in extreme greed

In corporate news, Exxon Mobil (XOM) reported better-than-expected earnings and revenue, but the company's energy production levels declined. Shares rose slightly.

Merck (MRK) shares declined after the company topped earnings expectations but gave a cautious outlook for 2013.

Shares of toy maker Mattel (MAT) edged higher after the company said it is raising prices globally. Mattel is making the move after it missed earnings and sales forecast for the fourth quarter, which includes the holiday shopping period. The company, which is behind brands like Hot Wheels and Fisher-Price, said sales of Barbie brand products slipped 4% last quarter.

Dell (DELL) shares climbed almost 5% after a Reuters report said the PC maker is nearing a deal to go private as early as Monday.

Zoetis (ZTS), an animal-health company owned by drug giant Pfizer (PFE), raised $2.2 billion in its initial public offering late Thursday, with shares pricing at $26 each, well above the target range. Shares jumped 20% on the first day of trading. Zoetis' IPO is the largest since Facebook Inc raised $16 billion last May.

Google (GOOG) shares rose more than 2%, hitting an all-time high of $776.60.

European markets ended solidly higher. Asian markets were mostly firmer, led by gains in Shanghai, which shrugged off the mixed news about China's manufacturing sector. Two separate purchasing managers' surveys on China showed manufacturing activity continued to expand in January, but painted a mixed picture on the pace of recovery.

The dollar rose against the British pound and Japanese yen, but edged lower versus the euro.