JCPenney ousted CEO Ron Johnson earlier this week. Now the retailer is working with investment firm The Blackstone Group to figure out ways to raise cash, according to two sources familiar with the process.

Blackstone (BX) is seeking to raise up to $1 billion to keep JCPenney solvent and is also talking to several private equity firms about acquiring a minority stake in the retailer, according to one of the sources

Private equity firms, including Leonard Green, are taking a look at JCPenney's books, said a third source familiar with the process. Other potential suitors include TPG, KKR (KKR) and Apollo Management (APO), according to press reports.

JCPenney did not return calls for comment. A Blackstone spokesperson declined to comment.

The reports did little to quell concerns about the future of the retailer. Neither did the news that it won a key round in its court battle with Macy's (M) over the right to sell Martha Stewart Living (MSO) products.

JCPenney's (JCP) stock dropped 2% Friday. Shares of the retailer are down 26% this year.

Related: Penney can still sell some Martha Stewart products ... for now

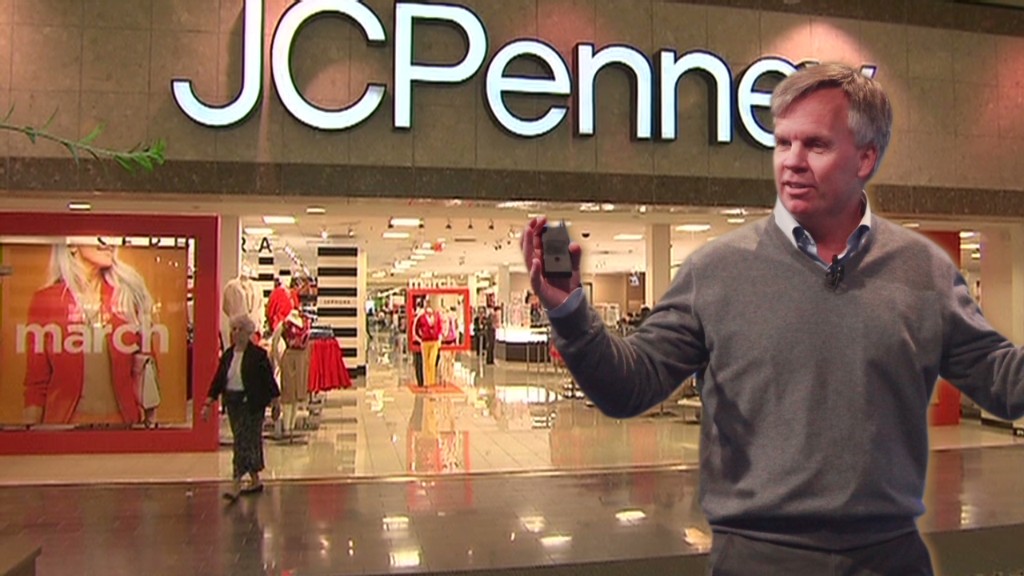

Earlier this week, JCPenney announced that Johnson, its once heralded CEO and former retail chief at Apple (AAPL), would be replaced immediately by Mike Ullman, who was the CEO of JCPenney before Johnson.

Johnson's tenure at the helm of the retailer was marked by dashed hopes.

Hedge fund manager Bill Ackman had helped lure Johnson to the Plano, Tex. company in late 2010, but Johnson's plans to revolutionize how consumers shop in department stores fell flat. JCPenney alienated its old customers and didn't gain many new ones. Revenues continued to plunge and losses mounted.

Now Ullman must make quick decisions about where to cut costs.

JCPenney's former chief marketing officer Mike Boylson, who retired shortly after Johnson took over, told CNNMoney the day after Johnson's firing that Ullman was known for both his work ethic and swift decision making.

"He loves challenges like this," said Boylson. "People underestimate how fast he can move on things."

Ullman, Boylson added, also lives in Texas and was always known for being in the office nearly round the clock.

That's an important point. One of the reasons that led to Johnson's ouster was that he commuted back and forth between Texas and his family's home in California, according to a fourth source who was familiar with the board's decision.

Fortune's Dan Primack contributed to this report.