World stock markets look set to bump around awhile after last week's plunge in Japan before resuming a rally fueled by cheap central bank cash.

Investors had a rude awakening last Thursday as the Nikkei index plunged by over 7% in its worst day for two years, leaving some wondering whether the surge in global equities was now over after such a significant pullback.

"This is a classic holiday market reversal," said Neil Shah, a director at London's Edison Investment.

When investors and traders return to their desks after the long weekend in the U.S. and the U.K., stocks would continue moving higher, he said.

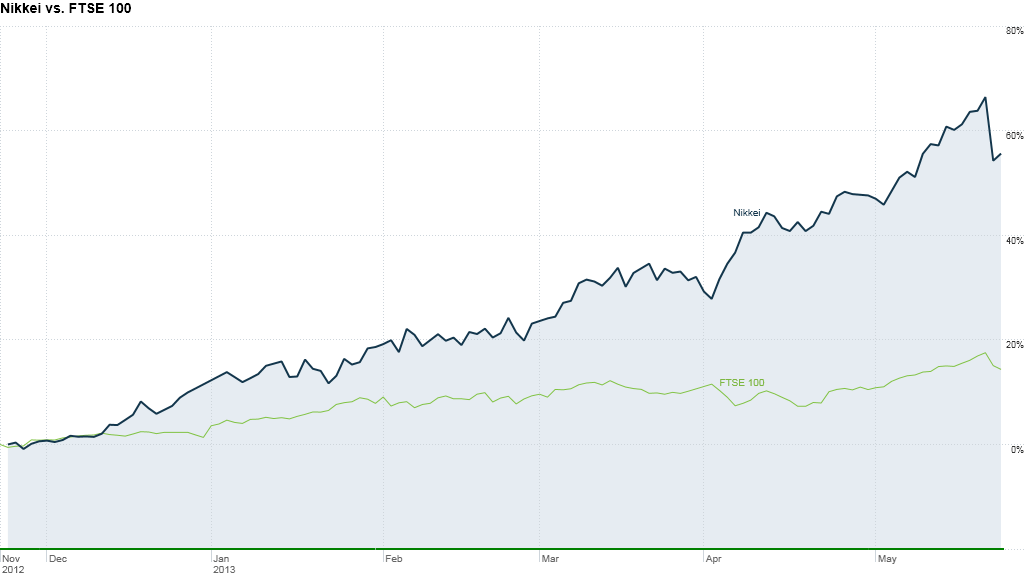

Japan, where the benchmark Nikkei index has rallied by more than 70% in less than 12 months, could see a more substantial correction before turning higher again.

"I expect another 5% to 10% downside before another march upwards," said Nick Beecroft, senior market analyst at Saxo Capital Markets.

The Nikkei fell again on Monday, dropping 3% as a firmer yen weighed on the shares of exporters. But other Asian markets gained ground, as did major indexes in Europe.

Central banks, including the Bank of Japan, have been a big driver of the bull market in stocks. With inflation under control and no sign of an acceleration in global growth, there's little chance they'll start turning off the easy money tap any time soon.

Related: Doomsday investors betting on market crash

Major European indexes have posted more muted rallies than Japan or the U.S. over the past few months as eurozone countries continue to struggle with recession, but some investors expect stocks to keep rising in the absence of shocks.

"It will require something fairly fundamental to derail this process," said Shah.

Shah said the odds of another eurozone disaster were low, and markets were likely to continue "grinding higher."

London's FTSE 100 index has surged ahead by nearly 25% in the last 12 months and is nearing its record high from 1999.

"I wouldn't be surprised if we saw another 5% to 7% upside in the market," said Shah, referring to the London benchmark.

City Index's chief global strategist, Ashraf Laidi, is also forecasting a "continuing uptrend" for European markets, even though he expect stocks will pull back in the near term.

Laidi forecasts that central banks in the U.K. and Europe will continue loosening monetary policy, which will help support the region's equity markets.

"The dynamics from the central banks that have been propping the markets up for the past eight to nine months are here to stay," he said.

Related: Eurozone business still going backwards

In Europe, Germany's DAX index hit an all-time record high last week as the eurozone's largest economy continues to avoid the recession gripping much of the rest of the region. But markets in Spain, Italy and France have been trailing, as those countries struggle with contracting economies and high unemployment.

"Investors are favoring quality over risk where they can find it, which has led them to Germany where they have a healthier economy than many of the Mediterannean countries," said Gary Thayer, chief macro strategist from Wells Fargo Advisors.

"There are still long term issues that need to be solved in Europe, so the better performing countries have better performing markets," said Thayer.