Unless you've been living under a rock, you know that there is a major U.S. energy boom going on now.

This week, the sector will be in focus, with President Obama expected to unveil a national plan to combat climate change on Tuesday.

The energy renaissance has also been on the mind of portfolio manager Mark Freeman, who has been stocking up on companies that are benefiting from it. Freeman said his investments have been driven by the U.S. push to become energy independent and its focus on renewable energy sources.

"You get a powerful dynamic in achieving self-sufficiency," said Freeman, chief investing officer of Westwood Holdings Group, which manages $8 billion in assets.

American oil production has surged, and is expected to continue rising. It's lit a fire under energy stocks -- the S&P 500 energy sector index is up over 20% in the past year.

Freeman's firm has invested on all sides of the energy market, from domestic producers to infrastructure components to support services for oil drilling. Here are 4 stocks he's bought, and why he thinks they'll continue to be hot:

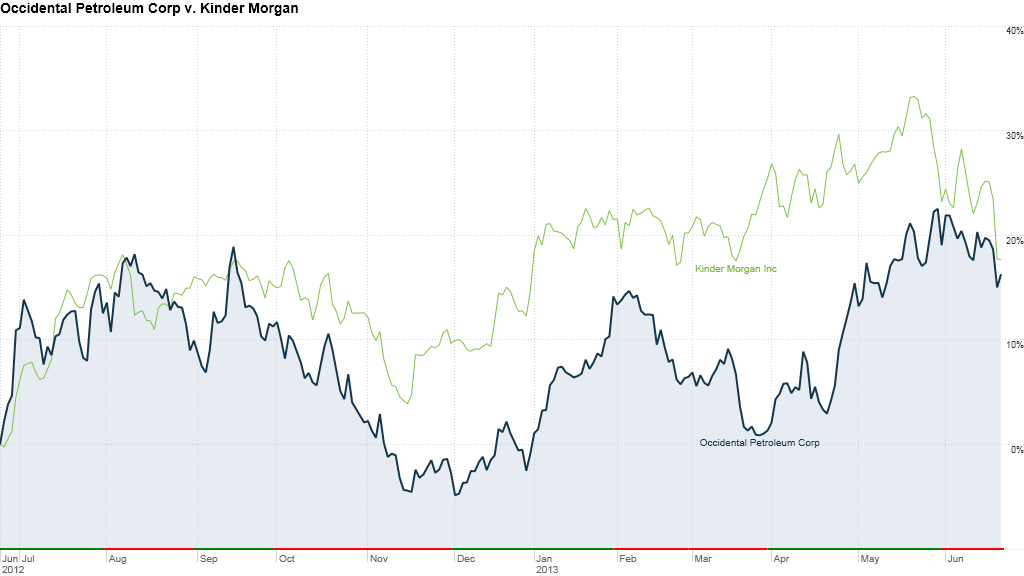

1. Domestic producer Occidental Petroleum Corporation (OXY)'s stock has risen 13% this past year. But Freeman believes it has more to go as the largest onshore producer in the United States.

2. Infrastructure components company Kinder Morgan (KMI), whose stock is also up 13%, has been big for Freeman. The company has 80,000 miles of pipelines that transport natural gas and petroleum products, and 180 terminals. Freeman believes those assets put Kinder in the perfect position to benefit from increased domestic production.

3. Freeman said that Union Pacific (UNP), a major railroad franchise, will benefit in the same way, because there will be more demand for crude by rail. The stock is up 32% in the past year.

4. Schlumberger (SLB), a leading oilfield services company, will be big, said Freeman. Energy companies will rely more on Schlumberger to get their work done because it helps supply technology and project management to the oil production industry. Its stock is up 16% this past year.

All these stocks are multi-year holdings for Freeman.