The stock market's double-digit gains are here to stay, but don't expect another huge rally during the second half of the year.

"The market's going to be taking a bit of a breather this half," said Gene Goldman, director of research at Cetera Financial.

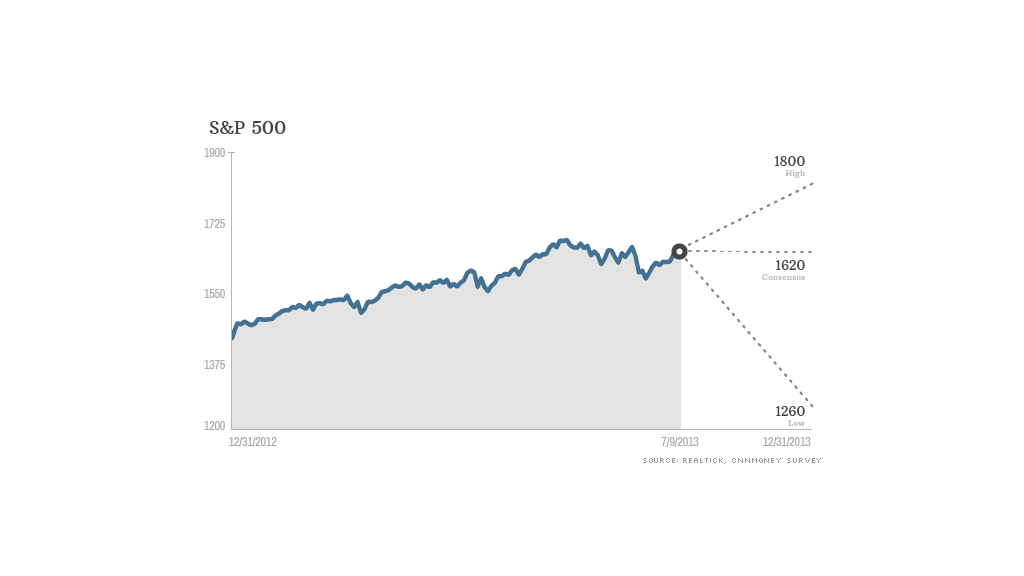

According to nearly 30 investment strategists and money managers surveyed by CNNMoney, the S&P 500 should end the year with a 14% gain at 1,620.

That's a more optimistic target than what experts predicted at the start of 2013, or even in April, when the market was up 10% for the year. But it's still 3% below the all-time highs reached in May.

Though the expectations for the remainder of the year are mild, hardly any of those surveyed are worried about the start of a bear market. They say the recent ups and downs are just a sign of increased volatility that will likely continue.

Experts blame the cool down in the rally on subpar economic growth, slowing corporate profit growth, and uncertainty over the Federal Reserve's monetary policy.

"I think we're at an inflection point for the market," said Kim Forrest, senior equity analyst at Fort Pitt Capital. "The U.S. economy is just limping along -- the improvements aren't quick or meaningful enough."

Plus, while quarterly earnings continue to top expectations, those expectations are very low and the growth rate continues to slow, said Forrest.

Related: The computers the run the stock market

One analyst even thinks the lack of earnings growth could more than just simmer the market down.

"We continue to view slowing profit growth as the most likely risk that will ultimately derail the stock market," said Dorsey Farr, partner with investment firm French Wolf & Farr. While investors have thus far brushed off the weakness in earnings, Farr thinks the disappointments will become too unhealthy to ignore.

Experts say investors will also refrain for making any big bets through the end of the year as long as the Fed's policies remain a wild card.

Last month, Fed chairman Ben Bernanke said the central bank could start pulling back on its $85 billion in monthly bond purchases later this year, and wind down the program entirely by mid-2014, as long as the economy improves in line with its expectations.

Related: The party could be over for stocks

The Fed's bond-buying program has been a boon to equity markets for several years, recently driving U.S. and global stock indexes to record highs.

While 70% of experts surveyed believe the Fed will indeed begin tapering its bond buying program this year, exactly when it might begin to do so remains up for discussion.

"The slow but recovering economy gives the Fed ammunition to think about pulling back on quantitative easing, but we're getting conflicting signals because inflation is still low and that's something the Fed is concerned with too," said Forrest.

And the impact of pulling back is anyone's guess.

"We've never had to unwind a quantitative easing program before, and we've already seen interest rates move up dramatically," said Peter Tuz, president at Chase Investment Counsel. "We don't really know the full impact a drawdown in stimulus measures will have."

While the consensus is calling for a more volatile second half, a handful of analysts were more optimistic.

"Earnings will surprise on the upside and the Fed won't take the punch bowl away as soon as everybody thinks," said Tom Schrader, managing director at Stifel Nicolaus. "Plus, historically, the market tends to perform better in the latter half of the year."