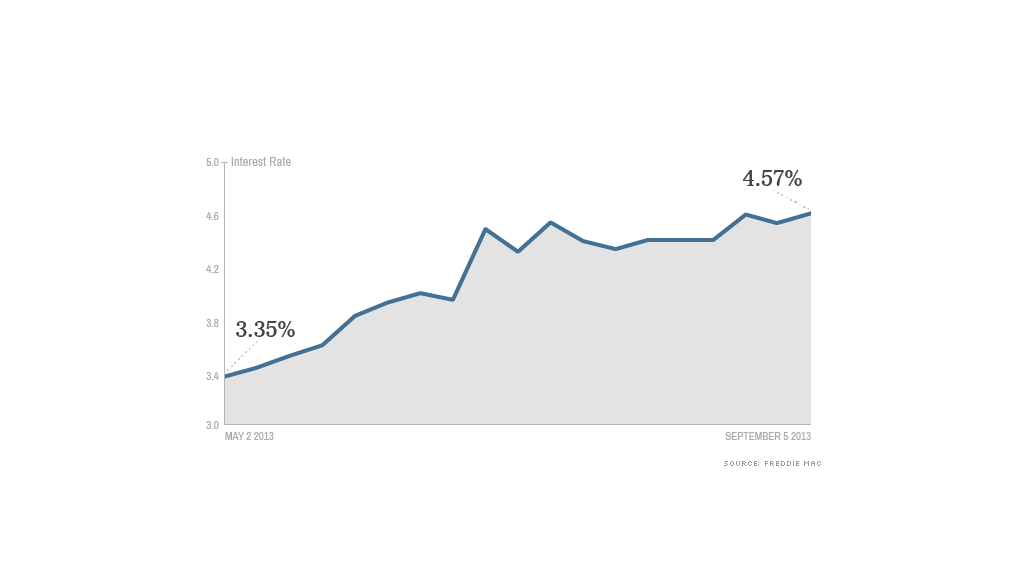

After a short-lived dip, mortgage rates have started edging higher again.

Rates on 30-year, fixed-rate mortgages reached an average of 4.57% this week -- up from 4.51% last week, according to mortgage giant Freddie Mac. And 15-year fixed rates were an average of 3.59%, up from 3.54%.

After reaching a two-year high of 4.58% in August, the 30-year fixed rate had eased slightly, giving some house hunters hope that rates would continue to fall. But rates once again moved upward amid signs of a stronger economic recovery, according to Frank Nothaft, Freddie Mac's vice president and chief economist. Last week, the U.S. government revised its estimate of the nation's second quarter gross domestic product to be significantly better than initially thought.

Related: Best advice now for homebuyers and sellers

In addition, expectations that the Federal Reserve would soon begin to slow its economic stimulus program have also been pushing rates higher since early May.

The average 30-year fixed rate is currently around one percentage point higher than it was just a few months ago, which will cost homebuyers around $56 more a month for every $100,000 they borrow.

Looking forward, rates will likely be influenced by Friday's job report, said Keith Gumbinger of HSH.com, a mortgage information provider. And if the economy continues to show signs of improvement, they could climb closer to 5% this fall, he said.

"As the economy shows signs of improvement, you can expect interest rates to continue to firm," he said. "I think the general consensus is things are getting better."