Amid increasing signs that high speed traders are getting early access to key market-moving information, New York Attorney General Eric Schneiderman is cracking down on what he calls 'Insider Trading 2.0."

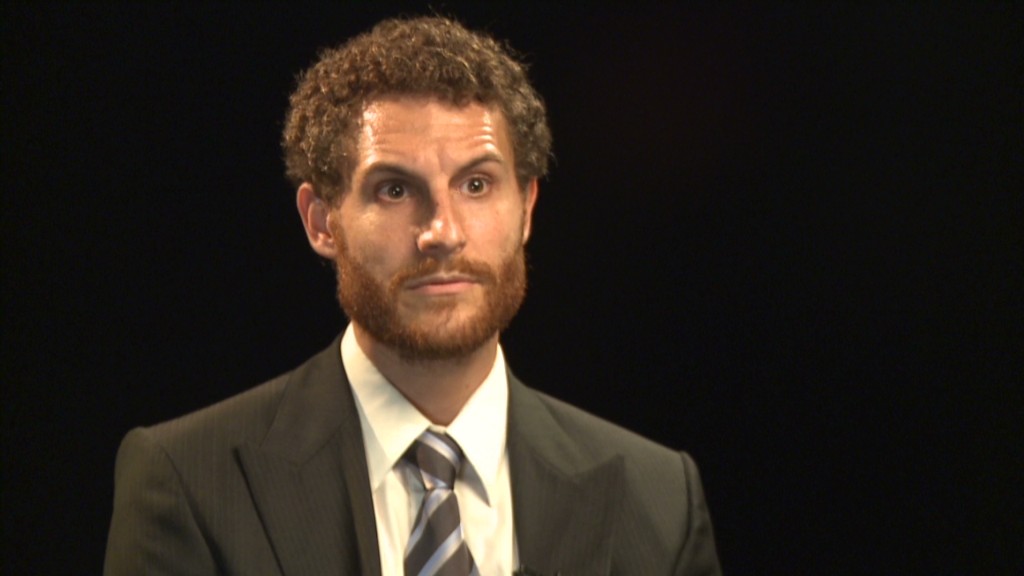

"When blinding speed is coupled with early access to data, it gives small groups of traders the power to manipulate market movements in their own favor before anyone else knows what's happening," said Schneiderman at the Bloomberg Markets 50 Summit in New York Tuesday. "They suck the value out of market-moving information before it even goes public."

Schneiderman went on to say the problem is "something far more insidious than traditional insider trading," and distorts the market in a way that notorious insider trader Ivan Boesky and the fictional Gordon Gekko couldn't even have imagined.

Last week for example, there were some suspicious moves in both stocks and gold just before and immediately following the announcement from the Federal Reserve that it would not cut back on its bond purchase program.

Related: High speed traders reacted instantly to Fed

And earlier this summer, Schneiderman's office reached an agreement with Thomson Reuters to suspend its early distribution of the monthly Thomson Reuters/University of Michigan consumer sentiment survey. Thomson Reuters had been providing the report to a small group of high frequency trading clients two seconds prior to its scheduled release for everyone else.

The impact of this change was significant. Schneiderman noted that trading volume in a top S&P 500 exchange-traded fund in the two seconds before the report has dipped dramatically since Thomson Reuters stopped giving it out early. In other words, it looks like all investors are now getting the information at exactly the same time.

Still, Schneiderman said his concern doesn't end with Thomson Reuters.

"We are aware that others are engaged in similar practices and are looking into those as well," he said, adding that his office is investigating the early release of Wall Street analyst recommendations to high frequency traders.

While Schneiderman's office is cracking down on this "new form of market manipulation," Schneiderman said there needs to be more comprehensive action from Washington.

"It isn't just the investors who get shut out of the trades who are hurt by this," said Schneiderman. "I believe this hurts the market as a whole ... nobody is going to invest if they think the markets are rigged."