If you're passionate about gay, lesbian, bisexual and transgender rights, there's now a way for you to track the stock performance of the nation's most LGBT-friendly companies and invest in them through a dedicated portfolio.

Credit Suisse (CS) launched the LGBT Equality Index this week, making it "the first index to track the equity performance of companies with LGBT-friendly policies," according to the firm's announcement. It also introduced the Credit Suisse LGBT Equality Portfolio, which is tied to the index, so that clients are able to invest in a basket of these companies directly.

To select companies for its index, Credit Suisse relied on the Human Rights Campaign's Corporate Equality Index. One of the country's leading gay rights groups, the Human Rights Campaign rates businesses from 0 to 100 based on their policies -- like whether they offer health benefits to same-sex couples or provide transgender-inclusive health insurance.

Only companies with scores of 80 or higher are included in Credit Suisse's index, which is currently made up of 201 stocks. Some of the biggest companies in the LGBT Equality Index include Wells Fargo (WFC), JP Morgan Chase (JPM), Apple (AAPL), Microsoft (MSFT), Google (GOOG) and Johnson & Johnson (JNJ).

Related: Out of the closet on Wall Street

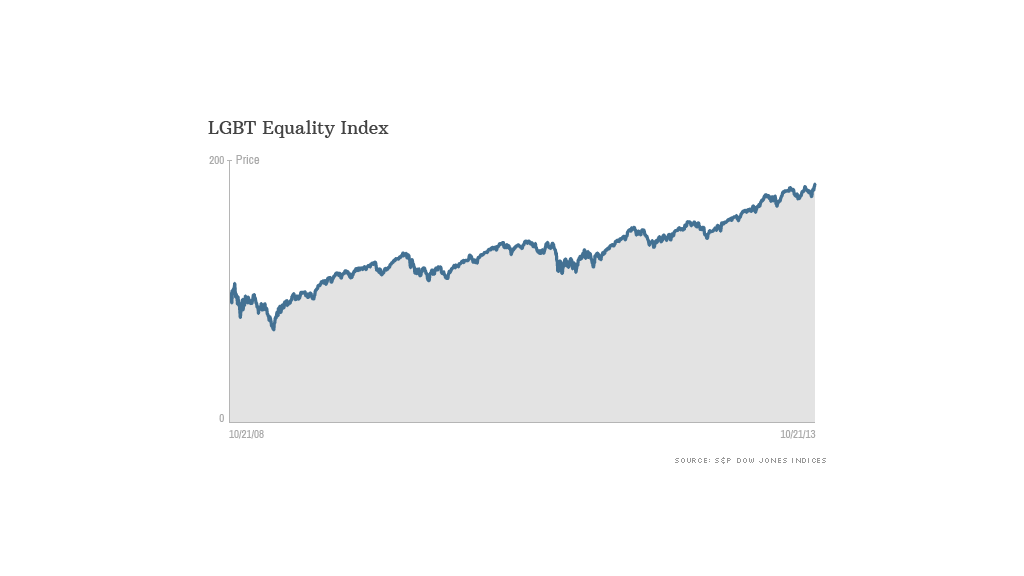

Over the past year, the index has seen a return of 22%, in line with the S&P 500 Index. Over five years, this group of stocks has seen an annual return of 13%, compared to 15% for the S&P 500.

"We are very pleased to be launching an Index that tracks the economic impact of LGBT-supportive policies," Timothy O'Hara, Credit Suisse's global head of equities said in a statement.

It's not your traditional portfolio, but socially responsible investing has been growing in popularity -- despite criticism that it can be more risky. Many funds, like those offered by firms such as Parnassus Investments, the AppleSeed Fund and TIAA-CREF, will screen out companies that manufacture alcohol, tobacco or weapons. Others only invest in companies that have strong environmental or labor rights track records.

Related: Find out if a company shares your values

There are also a number of faith-based portfolios that invest only in companies that are aligned with your religious beliefs. The Biblically Responsible Investing Company, for example, won't place your money in companies that donate to organizations that support abortion rights, provide domestic partnership benefits to lesbian and gay employees or are involved in the sale of pornography or cigarettes.

Wall Street has been increasing its focus on LGBT rights in recent years, with many firms boosting their policies and promoting their LGBT networks and stances on gay rights issues. Along with technology, finance is one of the industries with the highest number of companies boasting perfect HRC scores -- Credit Suisse included.