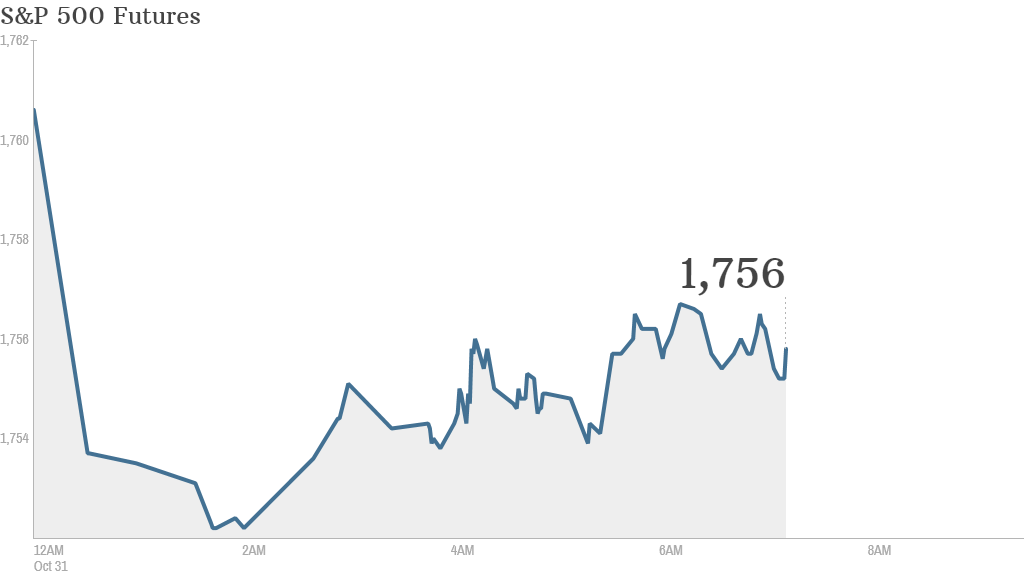

U.S. stock futures declined Thursday and global markets retreated as investors digested the latest statement from the Federal Reserve.

U.S. stock futures pulled back from all-time highs. European markets were mostly lower in morning trading and nearly all Asian markets ended in the red. Japan's Nikkei slid 1.2% as the country's central bank opted to maintain its massive stimulus program.

The Federal Reserve said Wednesday it will maintain its $85 billion per month stimulus program, which has helped support stocks around the world by pumping cash into the financial markets.

But some investors had hoped the Fed would adopt a more dovish tone in its statement. There were also expectations that the central bank would be more explicit as to the impact of the recent government shutdown on economic growth.

London-based CMC Markets analyst Michael Hewson said the failure to address the shutdown "appears to have caught the market off guard, given the recent and likely continued deterioration in economic data."

Related: Fear & Greed Index, still greedy

While the last day of October looks downbeat for stocks, the S&P 500 has rallied nearly 5% this month, and the Dow Jones Industrial Average has run up more than 3%.

Looking ahead to Thursday's economic reports, the Department of Labor releases weekly U.S. initial jobless claims at 8:30 a.m. ET.

A report out Wednesday from payroll processor ADP showed private sector employers added just 130,000 jobs in October -- the lowest level since April.

Investors are also expecting earnings updates from Exxon Mobil (XOM) and the New York Times (NYT) in the morning.

Royal Dutch Shell (RDSA) shares dropped in premarket trading after the oil producer reported a steep dip in quarterly profit, partly because of a "challenging operating environment" in Nigeria.

Estee Lauder (EL) reported that makeup sales rose in the third quarter, but profit declined.

AB InBev (BUD), the brewer of Anheuser Busch, reported Wednesday that sales and profit jumped in the third quarter.

Related: LinkedIn and Yelp sink of growth fears

Facebook (FB) bounced higher after the social media company reported earnings after the bell Wednesday that beat expectations. The stock reaction has been wild. Shares initially jumped 15% in after-hours trading, then slumped when the company said the number of teen users who were visiting the social networking site on a daily basis had fallen.