Hedge fund manager Dan Loeb revealed a stake in FedEx Tuesday morning, adding that he likes the stock and the management of the company.

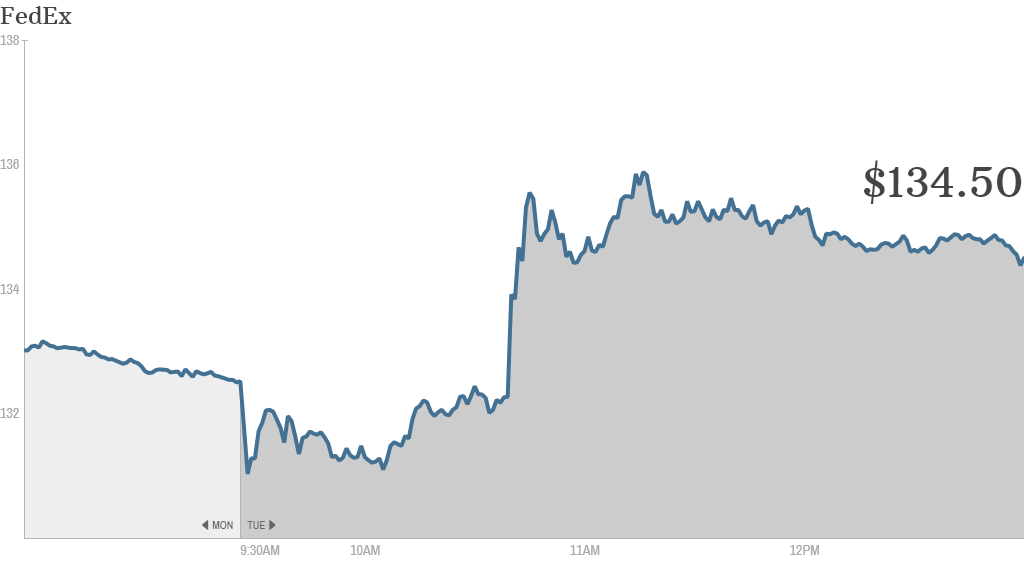

Shares of FedEx (FDX) spiked following the announcement.

Speaking during a conference Tuesday hosted by The New York Times Dealbook blog, Loeb told the audience that he met with FedEx CEO Fred Smith in Memphis last week.

"We had a very constructive discussion about the company," said Loeb, founder and CEO of Third Point hedge fund. "I think he disagrees with some of our notions...so life goes on. This is a normal part of the process."

Related: Cyber Monday to be busiest day ever for FedEx

Loeb is known for his activist approach and forcing change at companies. Most notably, he questioned the academic credentials listed in the bio of former Yahoo (YHOO) CEO Scott Thompson. The pressure from Loeb eventually led to Thompson stepping down. He was replaced by Marissa Mayer from Google (GOOG) and Yahoo's stock has been on a tear since she took over the company.

Despite his disagreements with Smith, Loeb said he likes him and will "absolutely not" try to oust him. Rather, Loeb called Smith one of the great American CEOs and entrepreneurs. But he was mum on the size of his position in FedEx.

Loeb also discussed his position in Sony. He is the largest stakeholder in Sony (SNE) and has been pushing the company to spin off its entertainment business. Though Sony has refused, Loeb doesn't consider that a lack of success.

Related: Dan Loeb bets on 'new' Nokia

"I don't think of us as going against Sony," he said, adding that he has a good relationship with the company and has met with Sony CEO Kazuo Hirai twice, most recently a few weeks ago in Tokyo. "We wanted a spinoff because we wanted transparency. We wanted to highlight the values. We wanted a greater focus on profitability and accountability, and they basically said they're going to do all of those things."

Loeb also responded to criticism from George Clooney, who compared Loeb's involvement in Sony to a Wal-Mart strangling businesses in small towns.

"That sounds a little hyperbolic," Loeb said, adding that he understands where Clooney is coming from. Loeb said he would love to meet Clooney and believes they would actually agree on the company more than they would disagree.

"I think we both want the same thing," Loeb said. "We want less money spent on overhead and more money spent on making movies."

Loeb also commented on his position in Herbalife (HLF). He bought a stake in the nutritional supplement company even as rival hedge fund manager Bill Ackman was shorting it and saying he thought Herbalife was a pyramid scheme. Loeb's feud with Ackman is highlighted in the December issue of Vanity Fair.

"Let's be clear about a couple things," said Loeb Tuesday. "I have a fiduciary duty to earn a rate of return for my investors. My fiduciary duty is to my investors, not Bill Ackman. An opportunity was created where we thought a sell-off in Herbalife was overdone. I spent my Christmas vacation last year analyzing the company."

Loeb bought shares of Herbalife last December, after Ackman's accusations sent shares of the company plunging. Loeb set a price target on the stock between $55 and $68 per share, but sold his position during the first quarter when the stock reached $44 per share.

"There is no duty to hold a stock until it hits the price target," Loeb said. "We decided to take the money and run. There was no pump and dump."