Markets may struggle to get going again Wednesday as investors wait for more quarterly results to pile in.

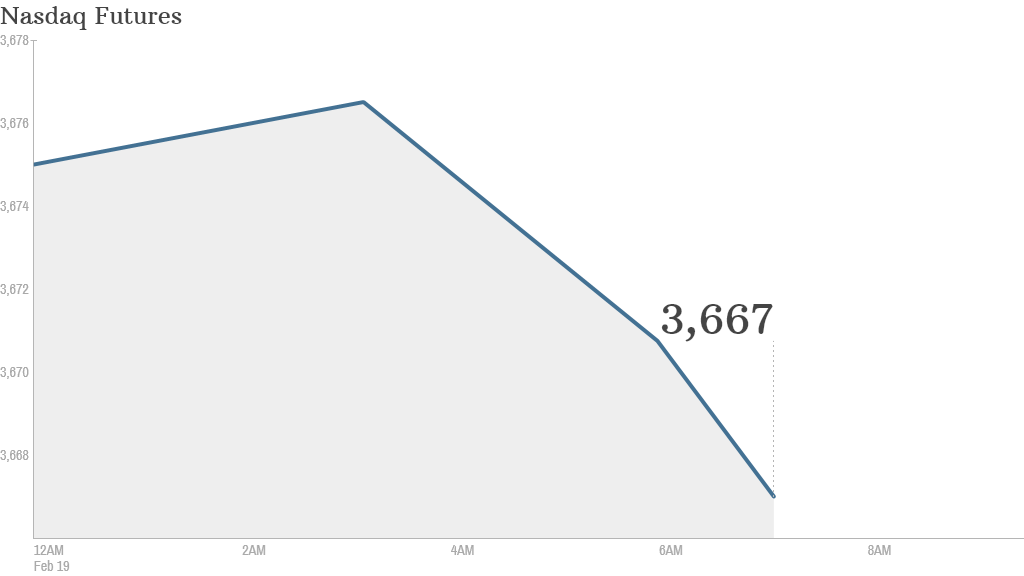

U.S. stock futures were lower ahead of the opening bell.

Shares of Zale (ZLC) surged about 40% after Bermuda-based Signet Jewelers (SIG) unveiled a deal to acquire the Dallas-based jewelry retailer for $21 a share.

Spirit Airlines (SAVE) shares took off in premarket trading, after the discount airline said that it more than doubled its adjusted net income for the quarter.

Herbalife (HLF) shares also jumped, after the controversial seller of nutrition products reported a double-digit percentage jump in quarterly profit, fueled by sales in China.

GPS device maker Garmin (GRMN) reported an increase in quarterly earnings on a slight drop in revenue. Shares were higher in premarket trading.

Tesla (TSLA) will report results after the close. The electronic car maker already said it sold a higher number of its Model S sedan in the fourth quarter.

Crocs (CROX) and Marriott International (MAR) are also slated to report after the closing bell.

Related: Fear & Greed Index still dwelling in fear

Some analysts say markets should brace themselves for greater volatility this year after a bumpy start to 2014.

"Sentiment may still be fragile after the big gains in equities over the past year and a half," noted Gary Thayer, chief macro strategist at Wells Fargo Advisors. "Further price volatility is likely in the weeks and months ahead."

The broader stock market barely budged Tuesday, as investors digested the latest batch of earnings and a big drug company merger.

But tech stocks remain on a hot streak. The Nasdaq has gained for the past eight days, reaching its highest level since January 2000.

On the economic front, the U.S. Census Bureau will release its monthly report on housing starts and building permits at 8:30 a.m. ET and the U.S. Bureau of Labor Statistics will release its monthly report on the producer price index, also at 8:30 a.m.

The Federal Open Markets Committee will release the minutes of its January meeting at 2 p.m.

Related: Will Tesla's bet on China pay off?

European markets were a touch weaker in morning trading.

In Ukraine, the currency was under pressure as more than 20 people died during anti-government protests.

Asian markets were mostly rising, except for Japan's Nikkei, which dipped down by 0.5%.