Some Google shareholders may be feeling like second-class citizens this morning.

The internet giant's controversial stock split occurred last night with trading commencing today. So far, investors seem to be favoring one share class over the other.

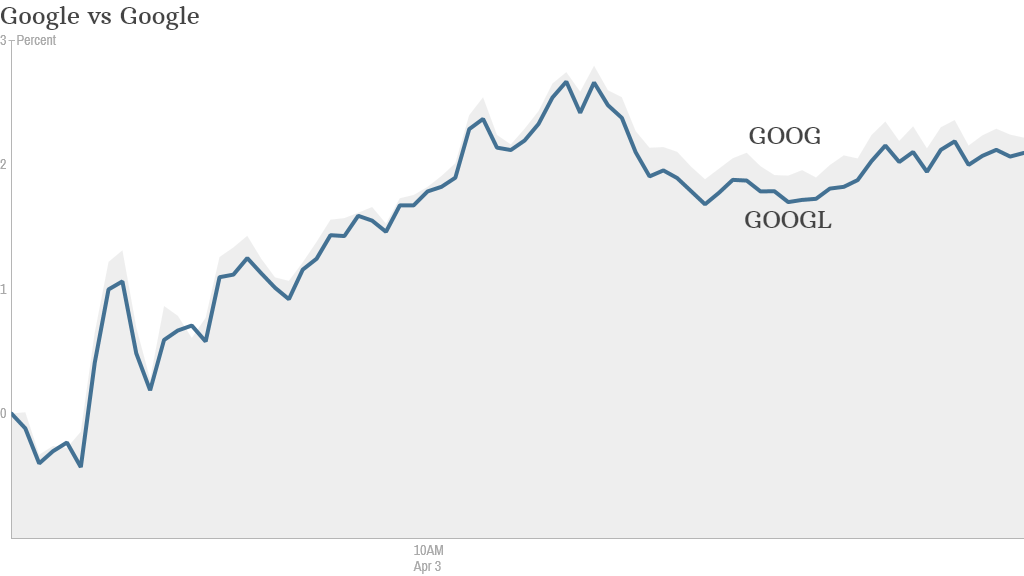

The newly issued Class C shares were priced at about $586 in early trading. Google's class A shares, which trade under the ticker "GOOGL (GOOAV)," were trading at more than $587.

Both shares continued to rise throughout the morning, but the slight differential in prices remains. Class A is clearly king.

The Class C shares, which trade under the old ticker symbol "GOOG (GOOG)," do not give investors the right to vote at Google's annual shareholder meeting. That could be why the price is lower than the Class A stock, which does have voting rights.

Google shareholders were issued two shares for every one share they owned at half the price.

Related: Google's evil stock split

The split was first proposed nearly two years ago as part of a plan to "preserve the corporate structure that has allowed Google to remain focused on the long term."

But the proposal was held up in court after shareholders sued to block it, arguing that the terms of the agreement were unfair.

Google already had a dual class share system. The company's founders hold Class B shares that are not publicly traded. Those shares come with 10 votes a piece.

In a weird quirk, the split means there are technically 501 stock "issues" in S&P 500, though the index is made up of only 500 U.S. companies.

There was no impact on the weighting of the index since the new issue was the result of a 2-for-1 split, according to S&P index analyst Howard Silverblatt.