If you believe in a 130-year-old theory about the markets, things are definitely looking up.

The theory holds that if both the Dow Jones Transportation Average (DJT) and Dow Jones Industrial Average (DJI2MN) indexes close at record highs, it's time to buy stocks.

On Wednesday, the Dow Transports index closed at an all-time high. Today, the Dow Industrials (often called "the Dow") surged to a new peak in early trading.

This thesis goes all the way back to the late 1800s and Charles Dow, the father of what is arguably the most famous market average of them all.

Simply put, Dow's belief was that when the companies that make things and the companies that deliver those things are both doing well, the economy must be doing better. That premise is generally a good sign for investors, whether you're a devotee of the theory or not.

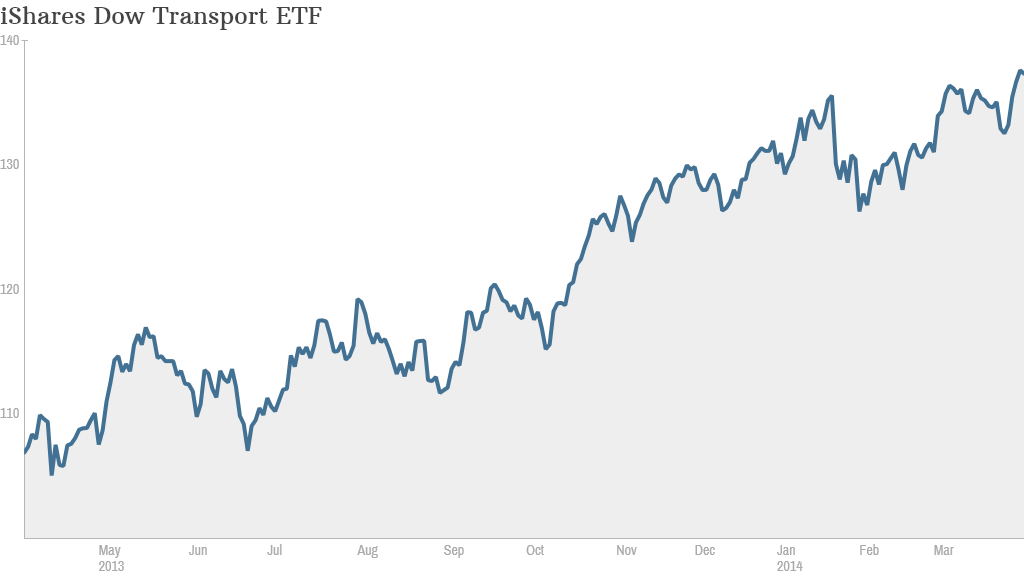

The stocks that make up the Dow Transports have been on a tear. The airlines have soared especially high with Alaska Air (ALK), Delta Air Lines (DAL), United Continental Holdings (UAL), and Southwest Airlines (LUV) all up more than 20% so far this year.

But the railroads haven't been holding back either with Union Pacific (UNP)up 12%, and GATX (GMT), a rail car leasing company, up 30% year to date.

Cue the jokes about someone hitting the accelerator.

According to Jeff Saut, Managing Director at Raymond James, the performance of the transport sector has to do with "the economy finally reaching escape velocity".

Saut says he's only seen one false "buy" signal after new closing highs from both the Dow Industrials and Transports indexes, and that was around the May 2010 Flash Crash.

Even then, the signal quickly reversed itself.

Investors like Saut are watching to see a new closing high from the Dow Industrials. That could set the stage for a potential "melt up" in stocks. He adds that many people are underinvested right now so there's plenty of money to put to work.

But Julius Maldutis of Aviation Dynamics doesn't necessarily think the "Dow theory" holds water.

He says airline stocks have been strong for a year and will probably peak in the middle of 2014. Maldutis says that airlines obviously benefit from a strengthening economy, but the big price appreciation in these stocks is really because of fundamentals.

The stuff most travelers complain about has helped the airlines. Maldutis says load factors are up because flights have been cut, and airlines have shifted from carrying some cargo to carrying mostly passenger bags and charging them more for it.

Airline management has also gotten much smarter about ticket pricing. Maldutis expects second quarter earnings to be the high point for airline stocks this year as investors start to feel that the price of the stocks are being fully reflected in profits and investors put on the breaks.

Charles Dow might agree with that.

After all, he did say, "To know values is to know the meaning of the market."

While the companies that make up the Dow Transports index look very different today than they did at the turn of the last century, Mr. Dow would likely be excited that two of his indexes are being watched very closely to see if a 130-year-old theory is still a growth engine indicator.