Good morning. It's going to be a busy day.

Here are the six things you need to know before the opening bell rings in New York:

1. Insights into employment: The monthly U.S. jobs report shows the nation added 242,000 new jobs in February. That was better than the 190,000 new jobs economists surveyed by CNNMoney expected, and was much better than January's gains of 172,000.

Unemployment remained at 4.9%, the lowest level since 2008.

Traders are watching these numbers closely as they will influence the Federal Reserve's thinking on whether to raise interest rates over the next few months.

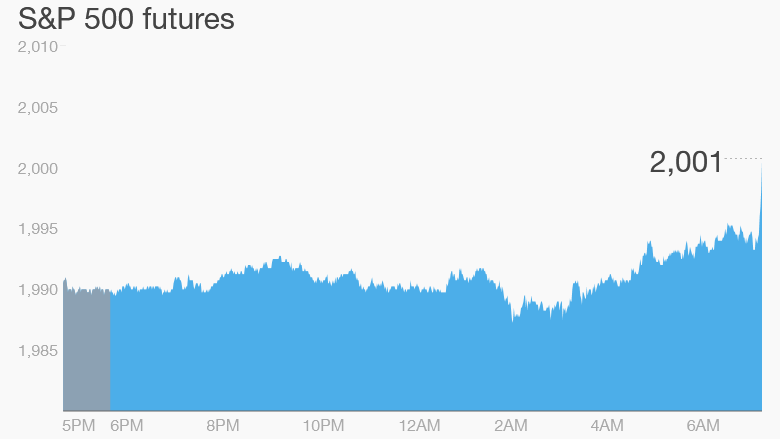

2. Global markets overview: Investors held back ahead of the jobs report, but now they're making big moves.

Stock futures in New York are rising, alongside European markets.

High-quality government bonds are being sold off and yields are rising as investors move into equities.

Meanwhile, most Asian markets ended the week with gains, even though they closed ahead of the jobs data release.

3. Takeover time: Movie theater chain AMC Theaters (AMC) is set to become the biggest in the world after it announced it would acquire Carmike Cinemas (CKEC) for $1.1 billion. AMC is controlled by Dalian Wanda Group, which is owned by China's richest man, Wang Jianlin.

A second deal was announced overnight: travel bag maker Samsonite (SMSEY) is buying its upscale American rival Tumi (TUMI) in a deal worth around $1.8 billion.

4. Potential market movers -- Intuit, Chesapeake, H&R Block, HP Enterprise: Shares in Intuit (INTU) could see higher-than-normal trading volumes after the company announced it would sell Quicken, which makes personal finance software, in a management buyout backed by a private equity firm.

Shares in Chesapeake Energy (CHK) are shooting higher premarket, following a 26% surge on Thursday. The company has been embroiled in legal troubles for a while. It was in the spotlight this week after its former CEO died in a car crash immediately after he was indicted by a grand jury for conspiring to rig the price of oil and natural gas leases.

H&R Block (HRB) stock is sinking in extended trading after the company reported weaker-than-expected earnings.

On the flip side, Hewlett Packard Enterprise (HPE) shares are rising after beating earnings expectations. HP (HPQ) and Hewlett Packard Enterprise split into two different companies in November.

5. Earnings: Investors are expecting a handful of companies to report quarterly results ahead of the opening bell, including Staples (SPLS) and Big Lots (BIG).

6. Weekly market recap: If you ignore Monday, it has been a very positive week for stocks.

The Dow Jones industrial average, S&P 500 and Nasdaq all rallied starting on Tuesday and notched four consecutive days of trading gains.