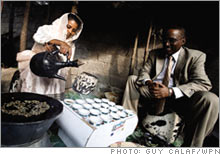

Starbucks vs. EthiopiaThe country that gave the world the coffee bean and the company that invented the $4 latte are fighting over a trademark, says Fortune's Stephan Faris.(Fortune Magazine) -- To produce a pound of organic sun-dried coffee, farmers in the southern Ethiopian village of Fero spread six pounds of ripe, red coffee cherries onto pallets near their fields. They sun the fruit for 15 days, stirring every few minutes to ensure uniform dryness, then shuck the shells. Last season, that pound of coffee fetched farmers an average price of $1.45. Figuring in the cost of generator fuel, bank interest, labor and transport across Ethiopia's dusty roads, it netted them less than $1. In the U.S., however, that same pound of coffee commands a much higher price: $26 for a bag of Starbucks' roasted Shirkina Sun-Dried Sidamo.

The price differential, says Getachew Mengistie, head of Ethiopia's Intellectual Property Office, is evidence that his country has been unable to capitalize on what he calls its intellectual property. The Fero coffee is an extreme example, but it's not the only one. Ethiopia's specialty beans routinely retail abroad for three times the price of ordinary coffee. Getachew, who like most Ethiopians goes by his given name, argues that if the higher rates were simply the product of investments in roasting, packaging or marketing, distributors could do the same with any coffee. Since they don't, he says, some of the extra value must originate where the beans are grown. "There is clearly an intangible value in the specialty coffee of Ethiopia," he says. "But it's not being captured here." The conflict That observation put the country that is the birthplace of the coffee bean on a collision course with the company that gave the world the $4 latte. The conflict began in March 2005, when Ethiopia filed with the U.S. Patent and Trademark Office to trademark the names of three coffee-producing regions: Yirgacheffe, Harrar and Sidamo, where Fero is located. It was an attempt to use tools usually reserved for corporations in developed economies to wrest profit from their distributors. By seizing control of these brands, the Ethiopian government planned to force those who sell its coffee into licensing agreements, eventually obtaining a larger share of the sales. But in the case of Sidamo, Starbucks (Charts) had got there first, with an application the year before to trademark Shirkina Sun-Dried Sidamo. Until that application was resolved, Ethiopia's claim could not go forward. The country asked Starbucks to drop its claim but received no answer for more than a year, says Kassahun Ayele, Ethiopia's ambassador to the U.S. at the time: "They said, 'You have to talk to our lawyers.'" The coffee company's objection was to Ethiopia's choice of intellectual-property protection. Trademarking is an unusual, though not unprecedented, choice for a geographic region. It gives the holder the exclusive right to use the name in branding, but it doesn't place any requirements on the product. Instead, Starbucks argues, Ethiopia would be better served by another form of protection, called geographic certification, used for such products as Idaho potatoes, Roquefort cheese and Florida oranges. It guarantees that the product comes from the stated region but allows others to use the name in their branding. Jamaican Blue Mountain and Kona coffees have geographic certifications. "I can't name one case where there are trademarks for coffee," says Dub Hay, senior vice president for coffee and global procurement at Starbucks. Ethiopia doesn't deny that its choice is unorthodox, countering that its industry, in which 95 percent of the coffee is produced by two million subsistence-level farmers, is too unwieldy and impoverished to take on the administrative burden required to guarantee geographic origin. "If you set up certification, you have to bear the cost," says Ron Layton, head of Light Years IP, a nonprofit intellectual-property consultancy that has been advising Ethiopia. More to the point, certification wouldn't require distributors to seek permission to use the names in their branding. Starbucks, for instance, could still sell Shirkina Sun-Dried Sidamo, as long as its beans came from the region. "It doesn't give you that control over the market," says Getachew. To blunt some of the opposition, Ethiopia has said it will not ask for royalties for its trademarked beans. The initial licensing requirements would be simply to label the beans prominently on the package and help in the promotion of Ethiopian coffee. "When demand for Ethiopian coffee grows, we will be able to ask for higher prices," says Getachew. Only if that strategy fails, he says, would other options, such as minimum prices, be pursued. For Starbucks, the scenario is a potential public relations disaster, pitting the coffee company, which had record revenue of $7.8 billion last year, up 22 percent over 2005, against one of the world's poorest countries. The Seattle company has no shops in Ethiopia or indeed in sub-Saharan Africa, but Starbucks does source 2 percent of its beans from Ethiopia, accounting for 2 percent of the country's crop. It has also spent $2.4 million in investments and loans in Ethiopia since 2002. "We need these coffee farmers to be in business," says Hay. |

Sponsors

|