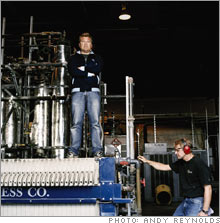

Soybeans in your gas tankA former airline pilot bets big on biodiesel.(FSB Magazine) -- After ten years of flying jets for Northwest Airlines, John Plaza decided during a long, cold layover that he wanted to change the world. "I was flying cargo planes from Anchorage to Tokyo," says Plaza, 41. "I did a rough estimate and realized that the tonnage of fuel it took to fly my 747 to Tokyo could power my Nissan Maxima for about 42 years." Inspired to launch a renewable-energy business, Plaza chose biodiesel, a clean-burning alternative to petroleum diesel that can be made from most types of vegetable oil. He cashed in his 401(k), mortgaged his home and sold his ski boat to buy a 5,000-square-foot warehouse in an industrial section of Seattle.

Plaza converted old brewery tanks for biodiesel production and imported the raw material - pure soybean oil - from farmers in Iowa. He pumped his first few gallons of biodiesel in April 2004. Imperium Renewables (imperiumrenewables.com) was in business. Today Imperium sells between 700 and 800 gallons of biodiesel a day to four regional fuel distributors and can't keep up with demand. Revenues in 2006 came to between $5 million and $10 million. By the end of the summer Imperium plans to open a new biodiesel refinery in Grays Harbor, Wash. The factory, built on a 25-acre site about two hours south of Seattle, will be among the nation's largest producers of biodiesel, refining up to 100 million gallons of canola- and soybean-based fuel a year. That's roughly 68 million gallons less than a full day's supply of diesel fuel for the U.S., according to Kline & Co., a market research firm in Little Falls, N.J. Biodiesel can be made from animal fat or any vegetable oil, including used cooking oil. It acts as a natural lubricant, is fully bio-degradable and burns cleaner than conventional diesel, reducing carbon monoxide emissions by 50 percent and carbon dioxide - the main greenhouse gas that causes global warming - by 78 percent. Unlike ethanol, which in high concentrations works only in specially designed vehicles, biodiesel will run virtually any diesel engine. According to the National Biodiesel Board (biodiesel.org), U.S. biodiesel sales have quintupled in the past three years, from 15 million gallons in 2003 to 200 million last year. Analysts expect sales to hit 800 million gallons by 2020. Biodiesel's fatty raw materials cost more per gallon than the crude oil from which diesel is refined, although government subsidies help keep costs competitive. A federal tax break gives Imperium and other biodiesel blenders a $1 credit for every gallon of biodiesel they produce, allowing them to pass the savings on to customers. At presstime regular diesel prices averaged $2.40 a gallon, while pure biodiesel ranged from $1.50 to $2.50 a gallon. Obviously it makes more economic sense to buy biodiesel when conventional fuel prices rise, as they did in the fall. Brian Campbell, 32, uses Imperium's biodiesel to run two tugboats in Puget Sound. He reckons that his company, Campbell Maritime (campbellmaritime.com), has saved roughly $5,000 annually in fuel costs over the past two years by using biodiesel. Campbell says that on average his biodiesel - a blend of 99 percent soybean oil and 1 percent regular diesel - is 10 to 15 cents cheaper per gallon than regular diesel. "The boat operates just the same," says Campbell. "You'd never know you weren't running on normal diesel." Like Campbell Maritime, most Imperium fuel users are based in the Pacific Northwest. They include construction companies, municipal bus fleets and the Port of Seattle. Clients have an incentive to use biodiesel because new city and state laws require local industry to reduce greenhouse-gas emissions. In the biodiesel market the role of Saudi Arabia is played by Midwestern farmers, who grow the vast bulk of the U.S. soybean crop. Most of the nation's 85 biodiesel refineries - and the 65 refineries under construction - are also in the Midwest. But more than 60 percent of U.S. biodiesel is consumed on the two coasts. Soybeans don't grow well in Washington State, so Imperium currently pays about 20 to 25 cents a gallon to ship soybean oil from the Midwest on railcars. Imperium has been trying to persuade local farmers to plant rapeseed (canola), which has the same energy value as soybeans when refined into biodiesel. On Jan. 30, local canola grower Natural Selection Farms delivered 6,000 gallons of canola oil to Imperium, the first batch of a raw material that the founders hope will generate at least 50 percent of Grays Harbor's total biodiesel output over the next five to ten years. "The way to do fuel is to be close to your customers," says Plaza's partner Martin Tobias, 42, a venture capitalist who serves as Imperium's CEO. Most of the nation's diesel engines run trucks, tractors and construction machinery. Diesel cars account for just 0.2 percent of all consumer vehicles sold in the U.S. In the 1970s the diesel cars sold in the U.S. earned a reputation for having smoke-belching, noisy engines. A new generation of cleaner, quieter diesel cars is starting to enter the U.S. market, many from European manufacturers such as Volkswagen (Charts). Biodiesel boosters hope these cars, which can get as much as 30 percent better mileage than gasoline-powered vehicles, will spur demand for clean fuel. Yet a problem remains. Only about 1,050 of the nation's 121,446 gas stations sell biodiesel. Tax breaks notwithstanding, convenience still trumps price for most diesel buyers. "Private users want inexpensive fuel that's readily available," says John DeCicco, a senior fellow of automotive strategies at Environmental Defense (environmentaldefense.org), a New York City-based nonprofit organization. "To realize biodiesel's potential, there needs to be a major shift in public policy." Today only a handful of local governments require the use of biodiesel (see map). The most ambitious municipality is Portland, Ore., which passed a law last year requiring all diesel sold within city limits to contain at least 5 percent biodiesel. But some help is on the way. In 2005, Congress authorized the EPA's Renewable Fuel Standard (RFS) Program, an ambitious plan that requires fuel blenders to incorporate 7.5 billion gallons of renewable fuel a year by 2012. The program, which takes effect later this year, aims to cut U.S. petroleum consumption by 3.9 billion gallons annually, or roughly 1.6 percent of the fossil fuels that would otherwise be used for transportation. Until more such initiatives kick in - or until taxes rise to capture the environmental and military costs of our country's dependence on fossil fuel - the biodiesel industry will depend on a committed minority who hope to save money while they help save the planet. "Bio diesel's better for my engines, better for the air and better politically," says Seattle tugboat operator Campbell. How's that? Simple, he explains. "You're sending fuel money to the Midwest instead of Saudi Arabia." Please send feedback or column ideas to: fsb_mail@timeinc.com. Are you an entrepreneur who started your own company and now has a parent (or two) working for you? For a future article in Fortune, we'd like to hear from you! Please e-mail (afisher@fortunemail.com) and tell us about your situation - what kind of company you have, how your mom or dad came to be your employee, and how we can contact you for more information (phone or e-mail) during business hours. Many thanks! ------------------------------ A biofuels startup can't deliver on its promises |

Sponsors

|