Autos: 2011 winners and losers (so far)

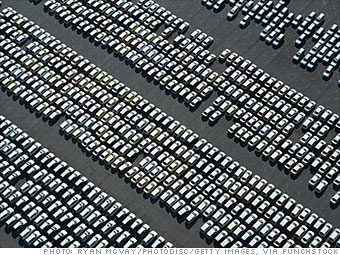

It's been a tough year so far, but U.S. automakers have weathered the storm remarkably well. As for the rest...

There is economic uncertainty every year, but this year it seems to be especially virulent. New concern about the U.S. budget deficit and government debt pushed Congress to the brink; uprisings in the Middle East helped push the cost of gold to an all-time high; and growing prices of commodities raised anew the specter of inflation.

Meanwhile the Japan earthquake and tsunami have interrupted supply lines and played havoc with production by both Japanese and American automakers. What's worse is that nobody seems to have their arms around the issues, and problems keep spreading. Because of parts shortages, both Honda and Toyota are cutting production in the U.S.

On top of all that, steadily rising gasoline prices have renewed interest in small cars with alternative powertrains. According to one back-of-the envelope calculation by a Detroit Three executive, the market share for subcompact and compact cars has risen to 25% from the high teens, and the Toyota Prius is once again in short supply.

With three months gone in the calendar year -- and six months in the model year -- it is not too soon to start projecting the winners and losers for 2011.

NEXT: Winner: The U.S. car market