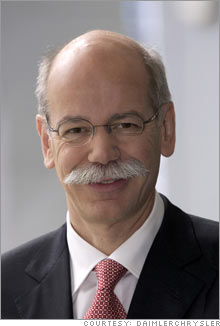

Daimler: Buyers have 'clear interest' in ChryslerAnnual meeting confirms talks ongoing with potential buyers for money-losing U.S. unit, but gives no details.NEW YORK (CNNMoney.com) -- DaimlerChrysler CEO Dieter Zetsche confirmed Wednesday that the company is talking with potential buyers who he said have a "clear interest" in buying its money-losing Chrysler unit, but he would not give details of discussions and said all options for the No. 4 U.S. automaker are still on the table. "In this context, I can confirm that we are talking with some of the potential partners who have shown a clear interest," he said early Wednesday in introductory remarks at the company's annual shareholder meeting in Berlin.

"But it is also true that we need to keep all options open, and that I cannot disclose any details, because we need to have the maximum scope for maneuver," he added, saying that the company's management requires "the greatest possible flexibility so that we can identify and then professionally implement the best possible solution." He said it would be "irresponsible" to give more details of the discussions at this time. "So far, I am satisfied with the process. Everything is going according to plan," he said. But some German shareholders at the meeting, while happy the company is moving to unwind the 1998 merger, expressed less confidence in the deal and DaimlerChrysler's management. ""If Chrysler is finally led before the divorce court judge, we would be very grateful," said Henning Gebhardt, head of German equities for Deutsche Bank (Charts) fund management arm DWS, according to wire service Reuters. "But what happens if you don't find a new bridegroom or if he demands an inappropriately high dowry?" Shareholder tracking service LionShares puts Deutsche Bank's holdings in DaimlerChrysler at 5.8 percent, making it second only to the Kuwait Investment Authority in terms of ownership. Reuters also reported that Hans-Richard Schmitz, representing shareholder activist group DSW, told Zetsche a Chrysler sale is needed to ensure DaimlerChrysler does not itself become a takeover target. "You can do the job yourself or a financial investor will come along and do the job for you," he said. Shares of DaimlerChrysler (Charts) were down 0.5 percent in Frankfurt trading following the remarks. The shares had been higher before the release of some of the introductory comments ahead of the meeting. Then German automaker Daimler-Benz paid $37 billion for Chrysler in 1998. Estimates are that Chrysler Group today will fetch less than $10 billion, due to both current financial losses and looming billions more in expenses for retiree health care coverage promised under its labor contracts. Zetsche said whatever option is chosen for Chrysler will require that turnaround plans at the unit are implemented. He said the company is also looking for the best possible option for its employees. He said that even if the North American unit is sold, Daimler may look to continue cooperation between Chrysler and the company's Mercedes unit if such partnership "makes financial sense for both sides." Zetsche announced Feb. 14 that the company would explore all strategic options for Chrysler, including a possible sale. The announcement came the same day that the company announced a $1.5 billion loss at Chrysler in 2006, along with plans to close several North American factories and cut 13,000 jobs to try to turn around its financial outlook. The Detroit News reported Wednesday that two of the nation's largest private equity firms, the Blackstone Group and Cerberus Capital Management, have made formal bids to buy Chrysler Group, as has Canadian auto parts supplier Magna International (Charts). The expectation is that the private equity firms would send Chrysler Group to the chop shop, perhaps selling off its Jeep brand to another automaker and further cutting capacity, and pushing the company's unions for wage and benefit concessions. Not surprisingly, the bids therefore could face strong opposition from DaimlerChrysler's unions in both North America and Europe. The paper reports that a dozen union officials, including United Auto Workers President Ron Gettelfinger, met for dinner in Berlin on Tuesday and reaffirmed that they hope Chrysler will remain a part of DaimlerChrysler and oppose a sale of Chrysler to a private equity group or other buyer that will dismember it. In comments at a UAW conference March 27, Gettelfinger said apprehension is justified among union members at Chrysler and various auto parts makers about the interest in the sector by private equity firms because many of those buyers "are out to increase their wealth by stripping and flipping the companies." Bob Chernecki, an assistant to Canadian Auto Workers President Buzz Hargrove, who attended the dinner Tuesday, told the News there was absolute solidarity among the union leadership to a sale of Chrysler to private equity groups. The Berlin dinner was attended by Erich Klemm, a German union leader who is vice chairman of DaimlerChrysler's supervisory board, the equivalent of the company's board of directors, the News said. Zetsche seemed to be addressing union concerns about job losses and plant closures in his prepared remarks when he said the company would follow the value of respect for its employees when making decisions about the future. "Having values does not mean that we are incapable of making tough decisions. Sometimes these values require us to make such decisions, especially if it's the only way to safeguard the future of our company and the vast majority of the jobs it provides," he said. "It's not a sign of respect to close our eyes to uncomfortable truths if only to discover at a later date that remedial action is much more painful." U.S. sales at the traditional Big Three automakers -- Chrysler, General Motors (Charts) and Ford (Charts) -- continued to lose share to Toyota Motor (Charts), Honda Motor (Charts) and other import brands in March, although a rebound in Chrysler sales from weak February levels allowed it to do a bit better than forecasts. In the first quarter, Chrysler had only 13.8 percent of U.S. sales, down from 14.3 percent in the same period of 2006, as its sales fell 4.4 percent. Zetsche told the shareholders that DaimlerChrysler managers "believe the Chrysler group has a much more competitive structure than its other American competitors." The unit had been profitable through early 2006, while GM and Ford struggled with losses in their core automotive operations that started in 2005. But GM and Ford have both won concession on health care costs from the UAW that Chrysler has yet to win. GM's North American auto operations nearly broke even in the fourth quarter while losses at Chrysler soared. What would Blackstone do to Chrysler? |

Sponsors

|